An unbiased, data-driven comparison of market intelligence, predictive capabilities, and revenue acceleration features

The sales intelligence landscape has transformed dramatically. As AI platforms reshape B2B selling, choosing the right sales intelligence solution can mean the difference between leading your market and playing catch-up. With the AI sales and marketing market projected to surge from $58 billion in 2025 to $240.59 billion by 2030 (representing a remarkable 32.9% CAGR), sales leaders face a critical decision: which platform delivers genuine competitive advantage?

This comprehensive analysis examines two distinct approaches to sales intelligence: SalesPlay - An AI Sales Intelligence Platform by MarketsandMarkets, which focuses on predictive market intelligence and opportunity identification before intent signals emerge, and Apollo.io, a widely-adopted contact database and engagement platform emphasizing prospecting volume and outreach automation.

Understanding the Sales Intelligence Revolution

Before diving into platform specifics, it's essential to understand the fundamental shift occurring in B2B sales. Traditional sales approaches relied heavily on manual research, intuition, and reactive prospecting. Modern AI sales intelligence platforms have revolutionized this paradigm by introducing predictive analytics, real-time market signals, and automated insight generation.

The sales intelligence market reached $4.42 billion in 2025 and is forecast to expand to $8.19 billion by 2030. This growth acceleration stems from AI's ability to compress prospect research cycles from several hours to mere minutes while processing intent signals from over 100,000 sources simultaneously.

The Paradigm Shift: From Reactive to Predictive Intelligence

Traditional sales intelligence platforms function as sophisticated databases—storing contact information, company data, and basic firmographics. While valuable, this approach positions sales teams in a reactive stance, responding to signals after opportunities have already materialized and competitors have engaged.

Advanced predictive intelligence platforms like SalesPlay represent a fundamental evolution, identifying revenue opportunities through real-time market shifts, ecosystem changes, and mission-critical priorities before traditional intent data surfaces. This proactive approach enables sales teams to engage prospects three to five weeks earlier than conventional methods.

SalesPlay: AI-Powered Market Intelligence and Revenue Acceleration

Core Philosophy and Approach

SalesPlay distinguishes itself through a market-first intelligence approach backed by MarketsandMarkets' extensive research infrastructure. Rather than merely aggregating contact information, the platform analyzes real-time revenue shifts, ecosystem signals, and organizational priorities to surface opportunities before competitors recognize them.

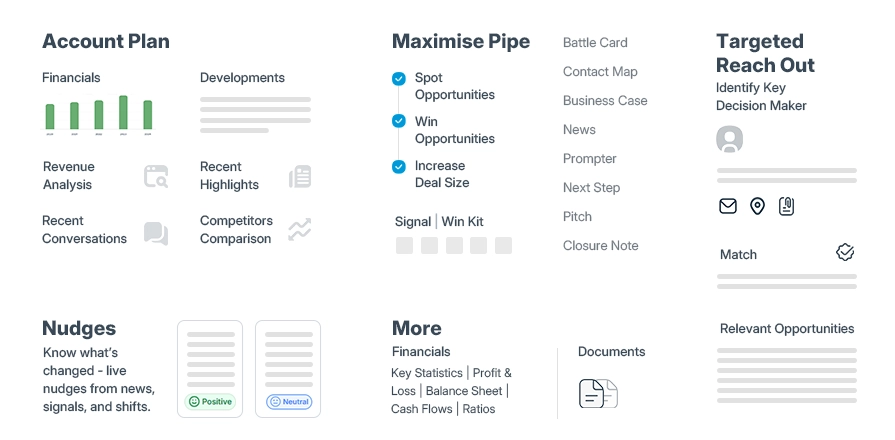

The platform operates on three foundational pillars designed to transform sales execution:

🎯 Opportunity Identification

SalesPlay detects opportunities before they exist by monitoring real-time revenue shifts, budget allocations, organizational changes, and ecosystem movements. This enables sales teams to engage prospects before RFPs are scoped or competitive evaluations begin.

🤖 AI Agent Execution

7 specialized AI agents collaborate across the entire sales cycle, automatically generating customized sales materials, ROI calculations, messaging frameworks, and strategic recommendations tailored to each specific opportunity.

🔄 Integrated Intelligence System

Unlike platforms requiring multiple tool integrations, SalesPlay provides a unified, hyper-personalized system that eliminates context-switching and consolidates intelligence, execution, and guidance in a single interface.

Unique Differentiators and Capabilities

Market Intelligence Foundation: Leveraging MarketsandMarkets' position as a trusted research partner to 80% of Fortune 2000 companies, SalesPlay accesses proprietary market intelligence covering over 15 million company profiles. This foundation enables unparalleled insight into organizational priorities, technology investments, and strategic initiatives.

Predictive Revenue Intelligence: The platform's predictive analytics identify buying signals before traditional intent data providers recognize them. By analyzing spending patterns, ecosystem partnerships, regulatory changes, and market dynamics, SalesPlay surfaces opportunities during the critical early evaluation phase when sales influence is maximized.

Automated Sales Enablement: Moving beyond research, SalesPlay automatically generates comprehensive sales materials for each opportunity, including customized presentations, value propositions, competitive positioning, ROI frameworks, and recommended engagement strategies. This automation enables every sales representative to execute with the precision of top performers.

Key Insight: SalesPlay transforms the sales process from research-heavy to execution-focused. While competitors stop at providing data, SalesPlay drives action through automatically generated, opportunity-specific sales materials and AI-guided recommendations.

Target User Profile

SalesPlay is optimally suited for:

- Enterprise B2B organizations pursuing strategic accounts with complex, multi-stakeholder sales cycles

- Account-based marketing teams requiring deep account intelligence and predictive opportunity identification

- Revenue operations leaders seeking to eliminate tool sprawl while maximizing intelligence quality

- Sales teams prioritizing early engagement and competitive differentiation over volume-based prospecting

Apollo.io: Comprehensive Prospecting and Engagement Platform

Core Philosophy and Approach

Apollo.io has established market presence as an accessible, feature-rich platform combining a substantial contact database with integrated engagement tools. The platform's primary value proposition centers on providing sales teams with immediate access to verified contact information while enabling direct outreach through built-in sequencing and communication capabilities.

Apollo positions itself as an all-in-one solution, consolidating prospecting, enrichment, and engagement functionalities that traditionally required multiple separate tools. This integration appeals particularly to small and mid-sized sales teams seeking to minimize technology stack complexity.

Database and Data Capabilities

Apollo maintains a database claiming over 275 million contacts across 73 million companies, with emphasis on breadth and immediate accessibility. The platform provides standard firmographic data including company size, revenue estimates, industry classifications, and technology usage information.

Contact data includes business email addresses, direct dial numbers, and mobile phone numbers, though access to premium contact information (particularly mobile numbers) operates on a credit-based system that can significantly impact total costs.

Engagement and Outreach Features

Apollo's built-in engagement capabilities include:

- Email sequencing: Automated multi-touch email campaigns with A/B testing and performance tracking

- Integrated dialer: Click-to-call functionality for both domestic and international outreach

- LinkedIn automation: Connection requests, direct messages, and social engagement through Chrome extension

- Task management: Follow-up reminders and activity tracking integrated with sequences

These features enable sales representatives to execute outbound campaigns without switching between multiple platforms, though users report varying results regarding deliverability and data accuracy.

Target User Profile

Apollo.io serves effectively:

- Small to mid-sized sales teams seeking affordable access to contact data and basic engagement tools

- SDR organizations focused on volume-based prospecting and multi-touch outreach sequences

- Startups and growth-stage companies building initial prospecting capabilities with budget constraints

- Individual sales professionals requiring simple, straightforward prospecting functionality

Head-to-Head Comparison: Critical Evaluation Criteria

Intelligence Depth and Market Insight

SalesPlay: Delivers comprehensive market intelligence extending far beyond basic firmographics. The platform analyzes spending patterns, ecosystem relationships, strategic priorities, technology adoption trajectories, and organizational changes to provide actionable context for every opportunity. This intelligence enables sales teams to craft positioning that resonates with prospects' actual business challenges and strategic initiatives.

Apollo.io: Provides standard contact and company data including job titles, employee counts, revenue estimates, and technology stacks. While useful for initial prospect identification, the intelligence layer remains primarily descriptive rather than predictive or strategic. Sales teams receive data points but must independently synthesize insights and develop positioning strategies.

| Intelligence Category | SalesPlay | Apollo.io |

|---|---|---|

| Predictive Opportunity Detection | ✅ Real-time revenue shift monitoring across 100,000+ signals | ⚠ Basic intent data available on higher tiers |

| Market Context | ✅ Strategic priorities, ecosystem analysis, competitive landscape | ❌ Limited to firmographic and technographic data |

| Engagement Timing Intelligence | ✅ Identifies optimal engagement windows 3-5 weeks early | ⚠ Job change alerts and basic triggers |

| Account Prioritization | ✅ AI-driven scoring based on propensity and market signals | ⚠ Customizable scoring models require manual configuration |

Verdict: SalesPlay provides substantially deeper intelligence that transforms how sales teams identify and engage opportunities. Apollo offers adequate data for basic prospecting but lacks the predictive and strategic intelligence that enables truly differentiated sales approaches.

Sales Enablement and Execution Support

SalesPlay: Automatically generates customized sales materials for every opportunity, including tailored presentations, messaging frameworks, ROI calculations, competitive differentiation points, and engagement strategies. The seven AI agents work collaboratively to ensure sales representatives have everything needed for compelling, relevant conversations without manual research and content creation.

Apollo.io: Provides templates for email sequences and basic calling scripts. However, sales representatives remain responsible for researching accounts, developing positioning, creating custom materials, and determining appropriate messaging. The platform facilitates outreach execution but doesn't reduce the substantial preparation work preceding engagement.

Data Quality and Accuracy

Data quality represents a critical differentiator with significant implications for sales productivity and brand reputation. Reaching incorrect contacts or outdated decision-makers wastes time, damages sender reputation, and creates negative impressions.

SalesPlay: Emphasizes data quality through MarketsandMarkets' research infrastructure and verification processes. The platform prioritizes accuracy over volume, recognizing that reaching the right person with relevant intelligence generates superior outcomes compared to high-volume, low-quality outreach.

Apollo.io: User reviews consistently highlight concerns regarding data accuracy, with reported email accuracy rates ranging from 70-80% in practice despite claimed 91% accuracy. Contact information staleness, particularly in international markets and niche industries, represents a frequent complaint. The credit-based pricing model adds complexity, as users consume credits accessing potentially outdated information.

Pricing Structure and Total Cost of Ownership

SalesPlay: Employs enterprise pricing with customized packages based on organizational size and requirements. While specific pricing requires consultation, the model emphasizes predictable costs aligned with value delivered. The platform includes dedicated Customer Success Manager support ensuring optimal implementation and ongoing value realization.

Apollo.io: Offers multiple tiers starting with a free plan providing limited functionality:

- Free Plan: 100 monthly credits, 5 mobile credits, 10 export credits, 2 active sequences

- Basic Plan: $49/user/month (annual) - Includes mobile credits but limited to basic features

- Professional Plan: $79/user/month (annual) - Adds advanced filters, sequences, and API access

- Organization Plan: $119/user/month (annual) - Full feature access with team management

However, Apollo's true costs extend beyond base subscription fees. The credit-based system for accessing mobile numbers (8 credits per number) and exports (1 credit per contact) creates unpredictable expenses that can substantially exceed initial projections. Users frequently report needing to purchase additional credit packages ($0.20 per credit with $50 minimum purchase) to maintain operational effectiveness.

✅ SalesPlay Advantages

- Predictive intelligence surfaces opportunities weeks before competitors

- Automated sales material generation saves 10+ hours weekly per rep

- Comprehensive market context enables strategic positioning

- Integrated system eliminates need for multiple point solutions

- MarketsandMarkets research infrastructure provides unique data access

- 7 AI agents provide continuous guidance and optimization

⚠ SalesPlay Considerations

- Enterprise-focused positioning may not suit very small teams

- Requires consultation for pricing (no self-service plans)

- Optimization period needed to maximize platform capabilities

- Best suited for strategic, account-based approaches vs. volume prospecting

✅ Apollo.io Advantages

- Large contact database with immediate accessibility

- Affordable entry-level pricing suitable for budget-conscious teams

- All-in-one platform reduces initial tool complexity

- Quick implementation with minimal learning curve

- Built-in engagement tools for immediate outreach capability

- Chrome extension enables prospecting from LinkedIn

⚠ Apollo.io Considerations

- Data accuracy concerns reported consistently by users (70-80% practical accuracy)

- Credit system creates unpredictable costs and usage complexity

- Limited predictive intelligence or strategic account insights

- Manual sales enablement - no automated content generation

- Frequent pricing changes and structure modifications

- International and niche industry data often outdated or incomplete

Integration and Technical Ecosystem

SalesPlay Integration Approach

SalesPlay operates as a comprehensive intelligence and execution platform designed to reduce tool sprawl rather than add another point solution to existing stacks. The platform integrates with major CRM systems (Salesforce, HubSpot, Microsoft Dynamics) to enrich existing records and sync opportunity intelligence bidirectionally.

The integration philosophy emphasizes intelligence augmentation—enhancing CRM data with predictive insights, market context, and automatically generated sales materials rather than requiring sales teams to work primarily within yet another interface.

Apollo.io Integration Capabilities

Apollo provides standard integrations with common CRM platforms, marketing automation tools (Marketo, Pardot), and sales engagement platforms (Outreach, Salesloft). The platform functions both as a primary workspace and as a data source enriching other systems.

However, organizations using Apollo typically maintain separate tools for conversation intelligence, revenue operations, advanced forecasting, and strategic account planning—creating the tool sprawl that increases complexity and reduces sales productivity.

Use Case Scenarios: Which Platform Fits Your Needs?

Scenario 1: Enterprise Account-Based Marketing Program

Situation: A technology vendor targets Fortune 1000 accounts with a six-figure average deal size and nine-month sales cycle involving multiple stakeholders.

SalesPlay Advantage: The platform's predictive intelligence identifies when target accounts begin early evaluation processes, enabling engagement before competitive RFPs are issued. Automatically generated account-specific materials demonstrate deep understanding of prospects' strategic priorities, technology ecosystems, and business challenges. The comprehensive approach aligns perfectly with strategic, relationship-driven selling.

Apollo.io Limitations: While Apollo can identify contacts within target accounts, it lacks the predictive intelligence to determine optimal engagement timing or the automated enablement to differentiate positioning. Sales teams must manually research each account and develop custom materials—consuming significant time while competitors using predictive platforms engage earlier.

Scenario 2: High-Volume SDR Organization

Situation: A SaaS company with a $15,000 average contract value employs 20 SDRs executing volume-based prospecting with quick evaluation cycles.

Apollo.io Advantage: The platform's immediate access to millions of contacts, built-in sequencing capabilities, and affordable pricing enable rapid campaign deployment. SDRs can quickly build lists, launch multi-touch sequences, and track engagement metrics without substantial upfront investment or technical complexity.

SalesPlay Consideration: While SalesPlay delivers superior intelligence and enablement, high-volume, transactional sales motions may not fully leverage the platform's strategic capabilities. Organizations in this category should evaluate whether predictive intelligence and automated enablement justify enterprise-level investment.

Scenario 3: Mid-Market Company Scaling Sales Operations

Situation: A 50-person sales organization seeks to improve win rates and reduce sales cycle length while managing budget constraints.

SalesPlay Advantage: The platform's ability to identify high-propensity opportunities and automate sales enablement directly addresses win rate and efficiency challenges. Sales representatives spend less time researching and more time selling, while AI-generated materials ensure consistent, compelling positioning. The integrated approach eliminates costs associated with maintaining multiple point solutions.

Apollo.io Alternative: Apollo's lower entry pricing may appeal initially, but the need for supplementary tools (intent data, conversation intelligence, enablement platforms) often results in comparable or higher total costs with fragmented workflows. Teams must evaluate total cost of ownership including productivity impacts of tool-switching.

Market Trends Driving Platform Evolution

The Rise of Agentic AI in Sales

The sales technology landscape is experiencing fundamental transformation as agentic AI systems—autonomous agents capable of reasoning, decision-making, and execution—emerge as the next evolution beyond simple automation. This shift represents more than incremental improvement; it fundamentally redefines how sales organizations operate.

SalesPlay's seven AI agents exemplify this evolution, collaboratively managing the entire opportunity lifecycle from identification through enablement to deal guidance. These agents don't simply provide data; they analyze situations, generate strategies, create materials, and recommend actions—functioning as virtual sales operations and enablement teams.

Companies leveraging AI sales tools effectively are 3.7 times more likely to exceed quota, according to recent industry research. This substantial performance differential stems from AI's ability to handle analytical and administrative work, enabling sales professionals to focus exclusively on relationship building and strategic selling.

Shift from Volume to Intelligence-Driven Prospecting

B2B buyers now complete 57% of their purchase journey before engaging sales representatives. This reality renders traditional volume-based prospecting increasingly ineffective—reaching decision-makers after they've formed opinions and identified preferred vendors generates limited influence over purchase outcomes.

Leading sales organizations are pivoting toward intelligence-driven approaches that identify and engage prospects during early evaluation phases when sales influence is maximized. This requires sophisticated predictive analytics and market intelligence—capabilities distinguishing advanced platforms like SalesPlay from traditional contact databases.

Integration Consolidation and Platform Simplification

The average sales technology stack grew to 15 tools by 2025, creating substantial friction through constant context-switching, data silos, and workflow fragmentation. Sales representatives reported spending up to 40% of their time navigating between systems rather than engaging customers.

This complexity is driving demand for comprehensive platforms that consolidate intelligence, enablement, and execution. Organizations increasingly prioritize solutions that eliminate tool sprawl while delivering superior outcomes—precisely the value proposition differentiated AI platforms offer over point solutions.

Implementation Considerations and Success Factors

For SalesPlay Implementation

Maximizing SalesPlay's value requires strategic approach:

- Define ideal customer profiles precisely: The platform's intelligence is most powerful when targeting is refined. Clearly articulate account characteristics, buying signals, and market segments to optimize opportunity identification.

- Integrate with existing CRM workflows: Ensure bidirectional data flow between SalesPlay and CRM systems to enrich existing records and maintain unified sales processes.

- Train teams on intelligence utilization: While the platform automates material generation, sales representatives must understand how to leverage market intelligence and AI-generated content effectively in conversations.

- Establish feedback loops: Regularly communicate opportunity outcomes back to refine predictive models and improve recommendation quality.

- Leverage Customer Success resources: Utilize dedicated CSM support to optimize platform configuration, stay current with new capabilities, and address challenges proactively.

For Apollo.io Implementation

Organizations implementing Apollo should consider:

- Data quality validation: Test contact accuracy within your specific market segments before deploying large-scale campaigns to avoid damaging sender reputation.

- Credit usage monitoring: Track credit consumption patterns to predict actual monthly costs and avoid unexpected expenses.

- Complementary tool evaluation: Identify which additional platforms (intent data, enablement, intelligence) are needed to achieve strategic objectives.

- Compliance configuration: Properly configure GDPR, CAN-SPAM, and other regulatory compliance settings before beginning outreach.

- Sequence performance optimization: Regularly A/B test email messaging, timing, and cadence to improve engagement rates.

Real-World Impact: Performance Metrics That Matter

Ultimately, platform selection should align with measurable business outcomes. Organizations should evaluate potential solutions based on their impact on critical sales metrics:

📊 Pipeline Generation Velocity

How quickly does the platform enable identification and qualification of qualified opportunities? Predictive intelligence platforms typically accelerate pipeline generation by 35-50% by surfacing opportunities earlier.

🎯 Win Rate Improvement

Does the platform improve conversion rates through better targeting and positioning? Strategic intelligence and automated enablement typically increase win rates by 15-30% compared to generic approaches.

⏱ Sales Cycle Compression

Can the platform reduce time from initial engagement to close? Early engagement and relevant positioning often compress cycles by 20-40% by reducing evaluation friction.

💰 Average Deal Size

Does the platform enable more strategic, comprehensive solutions? Better account intelligence typically increases deal sizes by 25-45% through expanded scope and premium positioning.

⚡ Sales Productivity

How much time does the platform save on research and administrative tasks? Automated enablement can reclaim 10-15 hours weekly per representative for selling activities.

🎪 Revenue Predictability

Does the platform improve forecast accuracy and pipeline visibility? Enhanced intelligence typically increases forecast accuracy by 20-30% through better opportunity qualification.

The Verdict: Matching Platform to Strategic Objectives

Neither SalesPlay nor Apollo.io represents a universally "better" solution—optimal platform selection depends entirely on organizational strategy, sales motion, and performance objectives.

Choose SalesPlay When You Need:

✅ Predictive intelligence identifying opportunities before competitors

✅ Automated sales enablement generating custom materials for every opportunity

✅ Strategic account intelligence enabling differentiated positioning

✅ Integrated platform eliminating tool sprawl and context-switching

✅ Enterprise-grade support with dedicated Customer Success management

✅ Complex B2B sales requiring deep market understanding and strategic approach

Consider Apollo.io When You Need:

✅ Immediate access to large contact database for volume prospecting

✅ Affordable entry-level pricing for budget-conscious organizations

✅ Basic outreach automation and sequence management

✅ Simple implementation with minimal onboarding complexity

✅ Transactional sales motion prioritizing contact volume over strategic intelligence

Strategic Considerations for Decision-Making

If your organization sells complex B2B solutions with six-figure deals and multi-stakeholder processes, SalesPlay's predictive intelligence and automated enablement deliver substantial competitive advantage. The ability to engage prospects during early evaluation phases—armed with automatically generated, account-specific materials—directly impacts win rates and sales cycles.

If your sales motion emphasizes volume, quick evaluation cycles, and transactional deals, Apollo's accessible pricing and immediate contact availability may suffice. However, carefully evaluate total cost of ownership including supplementary tools needed for strategic objectives.

For mid-market organizations scaling operations, the decision hinges on strategic direction. Companies pursuing upmarket expansion with larger deals benefit from SalesPlay's intelligence and enablement. Organizations focused on volume and operational efficiency may find Apollo adequate initially but should plan for eventual platform evolution as sales sophistication increases.

Future-Proofing Your Sales Technology Investment

Sales technology investment represents both immediate operational decisions and strategic positioning for future competitiveness. Consider not only current needs but also platform trajectory and industry evolution:

- AI sophistication: Which platform demonstrates clear innovation roadmap in predictive analytics and agentic AI capabilities?

- Data quality trajectory: Is the platform investing in verification infrastructure, or is data quality declining as database scales?

- Integration evolution: Does the platform consolidate functionality to reduce tool complexity, or does it require expanding supplementary solutions?

- Market positioning: Is the platform aligned with industry trends toward intelligence-driven selling, or anchored in legacy volume-based approaches?

Organizations should evaluate platforms not solely on current capabilities but on strategic alignment with the future of B2B sales—increasingly dominated by AI-powered intelligence, predictive analytics, and automated enablement.

Frequently Asked Questions

Conclusion: Strategic Platform Selection for Revenue Growth

The choice between SalesPlay and Apollo.io transcends simple feature comparison—it represents strategic decision about how your organization approaches B2B sales in an AI-powered era. As the sales intelligence market accelerates toward $8.19 billion by 2030, sales leaders must determine which paradigm aligns with their competitive strategy.

Apollo.io serves as an accessible contact database with basic engagement capabilities, suitable for volume-oriented prospecting and organizations prioritizing immediate affordability over strategic intelligence. The platform delivers contact access and outreach automation but requires sales teams to independently develop market insights, positioning strategies, and custom enablement materials.

SalesPlay - An AI Sales Intelligence Platform represents the evolution beyond contact databases toward predictive intelligence and automated enablement. By identifying opportunities before traditional signals emerge and automatically generating account-specific sales materials, the platform enables sales teams to engage prospects earlier with more relevant, compelling positioning. This approach aligns with fundamental industry trends: AI-powered intelligence, strategic account focus, and consolidated platforms reducing tool complexity.

The AI sales and marketing market's projected expansion from $58 billion to $240.59 billion by 2030 reflects not merely technology adoption but fundamental transformation in B2B selling. Organizations leveraging advanced predictive intelligence and automated enablement gain measurable competitive advantages—compressing sales cycles by 20-40%, improving win rates by 15-30%, and reclaiming 10-15 hours weekly per representative for actual selling activities.

Ready to Transform Your Sales Performance?

Discover how SalesPlay's predictive intelligence and automated enablement can accelerate your revenue growth. Connect with our team to explore how AI-powered market intelligence identifies opportunities your competitors miss.

Schedule Your Demo TodayThe question isn't whether AI will transform B2B sales—that transformation is already underway. The strategic question is whether your organization will lead this evolution with predictive intelligence and automated enablement, or compete using legacy approaches as markets shift. Your platform selection today determines your competitive position tomorrow.

Choose the platform that aligns not only with current needs but with the future you're building. The sales teams winning in 2025 and beyond aren't those with the largest contact databases—they're the teams armed with predictive intelligence, strategic insights, and AI-powered enablement that transforms every representative into a top performer.