Cell Culture Reagents Market

Cell Culture Reagents Market by Type (Growth Factors, Supplements, Cell Dissociation Reagents, Buffers & Chemicals, Others), Application (mAbs, Vaccines, CGT), End User (Pharma Biotech, Diagnostic Labs, Academia, Others), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cell culture reagents market is projected to reach USD 8.95 billion by 2030 from USD 5.10 billion in 2025, at a CAGR of 12.1% from 2025 to 2030. The expansion of the global cell culture reagents market is primarily attributed to the global increase in biopharma manufacturing. The demand for biologics, such as monoclonal antibodies, vaccines, and recombinant proteins, is growing. This, in turn, is increasing the consumption of feeds, supplements, sera alternatives, buffers, and process additives in upstream workflows. Moreover, cell and gene therapy require high-quality, stable reagents to maintain cell health and enhance production. Therefore, they are driving the use of serum-free and chemically defined reagents, as well as custom cytokines and growth factors.

KEY TAKEAWAYS

-

By RegionThe North America cell culture reagents market accounted for a 39.6% revenue share in 2024.

-

By ReagentsBy reagent, the cell culture reagents market growth factors segment is expected to dominate the market in 2024.

-

By ApplicationBy application, the biopharmaceutical production segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End userBy end user, the pharmaceutical & biotechnology companies segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive LandscapeCompanies such as Thermo Fisher Scientific, Merck KGaA, and Danaher Corporation were identified as some of the key players in the cell culture reagents market, given their strong market share and product footprint.

-

Competitive LandscapeCompanies such as HiMedia Laboratories and Caisson Labs among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The global cell culture reagents market continues to expand at a stable pace due to the increasing number of laboratories and manufacturers that require scalable and reproducible cell growth workflows. There is a growing need for advanced media systems and feed strategies that enhance cell viability, titer, and consistency in upstream processing. As a result, this is leading to a significant increase in the usage of basal media, feeds, supplements, serum replacements, growth factors/cytokines, and buffers in both R&D and ??????production.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ business in the global cell culture reagents market is shaped by the rapid shift toward biologics, advanced therapies, and personalized medicine, which is driving sustained demand for sera, supplements, buffers, and process chemicals used in upstream processing and cell-based research. Expansion of development and manufacturing programs by biopharma companies and CDMOs is supporting extensive utilization of both research- and GMP-grade reagents, with strong growth in serum-free, chemically defined, and animal-component-free formulations that enable flexible, contamination-controlled workflows for monoclonal antibodies, biosimilars, vaccines, and cell and gene therapies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Biologics scale-up aiding high reagent consumption

-

Move to serum-free and chemically defined systems

Level

-

Higher upfront cost and longer optimization cycles

Level

-

Media/feed optimization as a service

-

GMP-grade ancillary materials for CGT and ATMP workflows

Level

-

Contamination risk and mycoplasma control

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Biologics scale-up aiding high reagent consumption

Biologics output is growing across monoclonal antibodies, vaccines, and recombinant proteins. These molecules are mainly made in mammalian cell culture. This implies repeat demand for feeds, supplements, and buffers. Even small gains in titer can translate into large reagent volumes at scale. More programs in clinical and commercial stages increase the number of parallel runs. This is supporting recurring reagent purchases across the year.

Restraint: Higher upfront cost and longer optimization cycles

Serum-free and defined systems often need adaptation and tuning. Some cell lines can struggle during the transition. Development can take time due to cell-type-specific needs and high-density effects. The R&D effort is not small, especially when productivity targets are tight. Initial costs for media, additives, and related equipment can be higher. Many groups still adopt them, but the upfront barrier can delay decisions.

Opportunity: Media/feed optimization as a service

High-throughput bioreactors are making media and feed screening faster and more structured. Scale-down models also support later-stage process work and comparability exercises. This creates an opportunity for suppliers to bundle reagents with optimization support. It also supports platform media strategies across multiple clones and products. Perfusion mimic and intensified culture screening further expand specialty feed demand. Overall, the market is shifting towards offering formulation and support.

Challenge: Contamination risk and mycoplasma control

Contamination is a practical challenge in routine culture work. Mycoplasma is a frequent contaminant in cell cultures and bioprocessing fluids. It has the ability to spread and spoil experiments or production runs. That makes routine testing and strong aseptic discipline crucial. When a contamination event occurs, end users lose time, batches, and money. This keeps demand high for tested, well-controlled reagents, but it also raises the operating burden.

CELL CULTURE REAGENTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

JW Therapeutics signed an agreement with Thermo Fisher Scientific support the clinical development and commercial manufacturing of leading CAR-T (Chimeric Antigen Receptor T-Cells) therapies. JW secured non-exclusive commercial access to Gibco CTS Dynabeads CD3/CD28 | More reliable access to a critical activation reagent for scale-up. Better fit for commercial-ready workflows. Supports repeatable processing across runs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cell culture reagents market is a comprehensive ecosystem that includes suppliers of raw materials and ingredients along with producers of reagents, distributors, and users in research and biomanufacturing. Further upstream, the market covers suppliers of amino acids, vitamins, salts, sugars, lipids, trace elements, recombinant proteins, and hydrolysates, as well as water-for-injection grade inputs and packaging partners. These partners supply sterile bottles, bags, and single-use fluid paths. Manufacturers of reagents then mix and produce feeds, supplements, serum-free/chemically defined media, buffers, and cell dissociation reagents, which are available as research-use and GMP grades along with QC testing and documentation. On the demand side, the users are pharma and biotech companies, CDMOs, CROs, academic institutes, hospitals, and clinical ??????labs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cell culture reagents market, By Type

In 2024, the growth factor types segment accounted for the largest market share due to the dependency on high-value workflows, surge in cell & gene therapy, and focus on immune cell expansion program. which, in turn, influences the market growth to regulate cell survival, proliferation, and differentiation. The demand is high in the production of cell and gene therapies, where cytokines and growth factors are used up continuously during the processes of cell activation, expansion, and final ??????formulation.

Cell culture reagents market, By Application

As of 2024, biopharmaceutical production represented the dominant application in the global cell culture reagents market. One of the key reasons for this is that biologics production on a large scale requires a lot of feeds, supplements, and buffers, which are used repeatedly. Additionally, multiple facilities are simultaneously running regular campaigns for monoclonal antibodies, vaccines, and recombinant proteins, which together maintain a constant demand for ??????reagents.

Cell culture reagents market, By End user

As of 2024, pharmaceutical and biotechnology companies accounted for the largest share of the global cell culture reagents market.; this mainly as they carry the highest number of cell culture operations volume across process development, clinical manufacturing, and commercial biologics production. Upstream workflows of these end users consumes huge, recurring lots of media, feeds, supplements, and buffers through seed train and scale-up ??????stages. They also invest heavily in cell line development, clone screening, and assay development, which adds steady reagent demand beyond manufacturing.

REGION

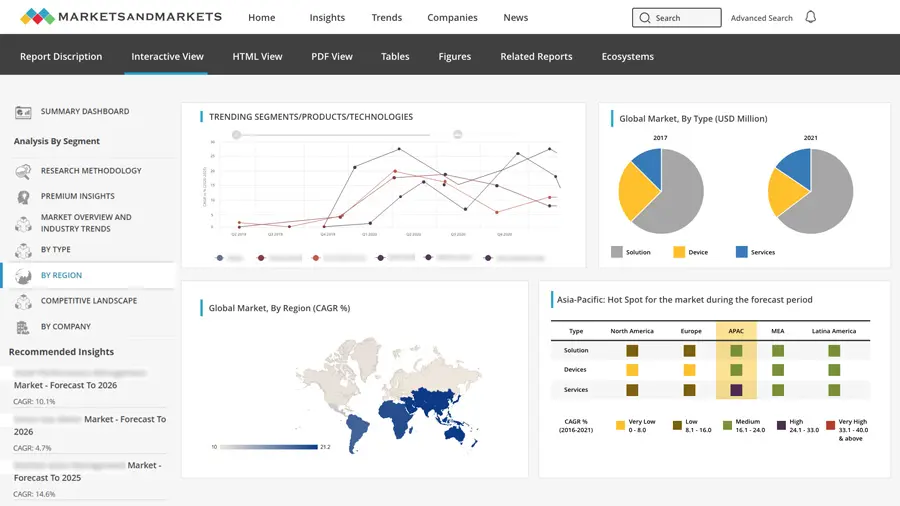

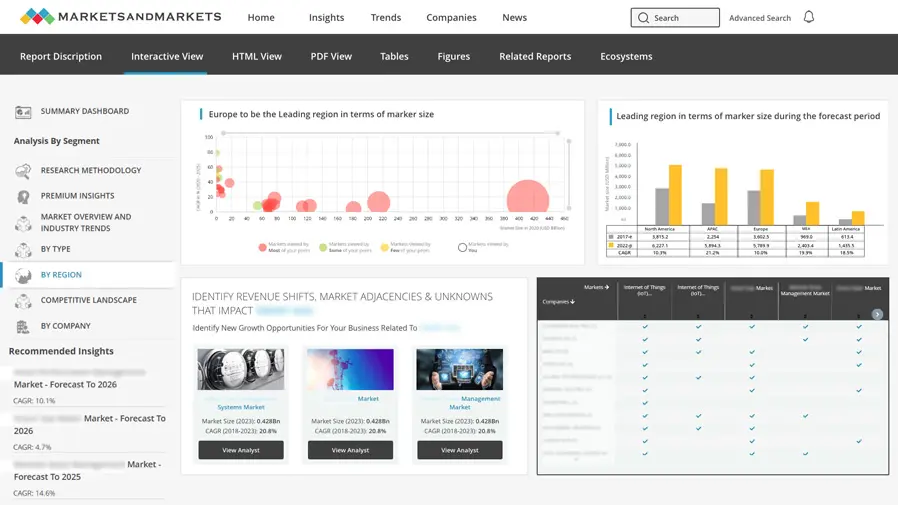

Asia Pacific to be the fastest-growing region in the cell culture reagents market during the forecast period

The Asia Pacific is the fastest-growing regional market for cell culture reagents, aided by rapid biomanufacturing build-out and strong government support in countries such as China, India, South Korea, Japan, and Singapore. Expansion of regional CDMO capacity, biosimilar scale-up programs, and increasing cell and gene therapy activity are significantly increasing the routine consumption of cell culture process reagents in both clinical and commercial facilities.

CELL CULTURE REAGENTS MARKET: COMPANY EVALUATION MATRIX

Thermo Fisher Scientific (Star) is a leading player in the global cell culture reagents market due to its broad, high-throughput portfolio used across research labs, biopharma manufacturers, and CDMOs. Through Gibco, the company offers widely adopted feeds, serum-free and chemically defined formulations, supplements, and buffers that are purchased repeatedly for routine culture, cell line development, and upstream production. FUJIFILM Holdings Corporation (Emerging Leader) is strengthening its position in the cell culture reagents market by expanding adoption of its media and supplement portfolio across both research and bioprocess workflows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific, Inc. (US)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Corning Incorporated (US)

- BD (US)

- Lonza (Switzerland)

- Bio-Techne (US)

- Fujifilm Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.70 Billion |

| Market Forecast in 2030 (Value) | USD 8.95 Billion |

| Growth Rate | CAGR of 12.1% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

WHAT IS IN IT FOR YOU: CELL CULTURE REAGENTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cell & gene therapy company (autologous/allogeneic) |

|

|

| Reagent manufacturer entering GMP segment |

|

|

RECENT DEVELOPMENTS

- November 2024 : Sartorius AG (Germany) opened its new Center for Bioprocess Innovation in Massachusetts, US.

- April 2024 : Merck KGaA invested ~USD 330 million (EUR 300 million) to expand its research center in Darmstadt, Germany. The Life Science business sector will research at the Advanced Research Center on solutions for manufacturing antibodies, mRNA applications, and other biotechnological products.

- December 2023 : Danaher acquired Abcam Limited, a provider of validated antibodies, reagents, biomarkers, and assays crucial for drug discovery, life sciences research, and diagnostics. Within Danaher's Life Sciences segment, Abcam will continue to operate independently, aligning with Danaher's mission to advance disease understanding and expedite drug discovery.

Table of Contents

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cell Culture Reagents Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cell Culture Reagents Market