Services NDT and Inspection Market

Services NDT and Inspection Market by Inspection Service, Equipment Rental Services, Calibration Service, Visual Inspection, Surface Inspection, Volumetric Inspection, Automotive, Aerospace, and Oil & Gas - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

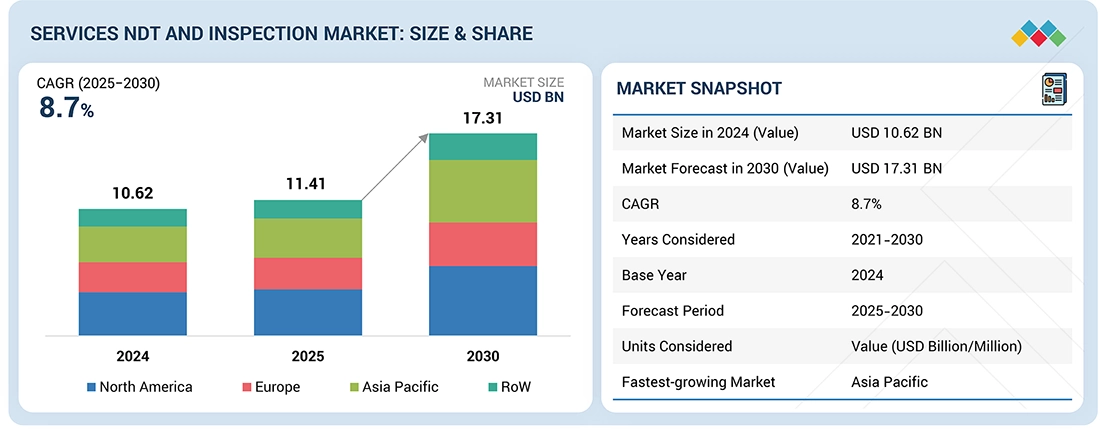

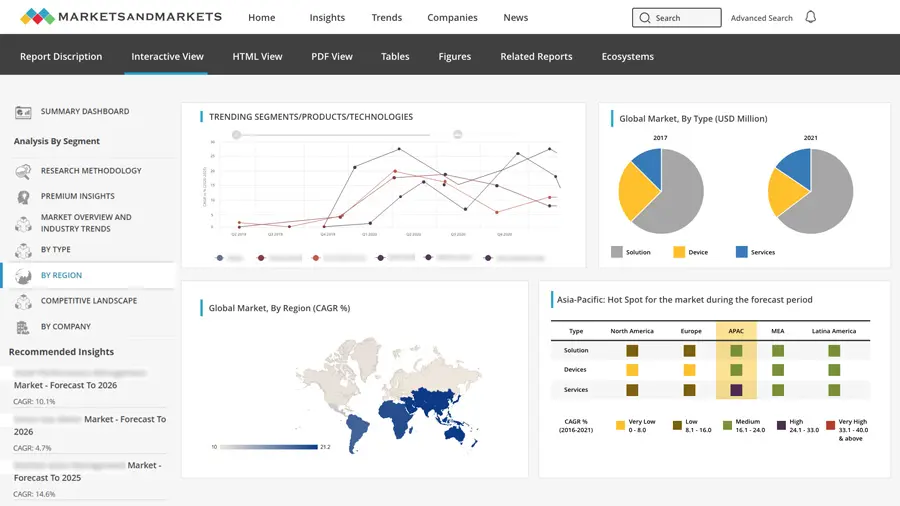

The services NDT and inspection market is projected to reach USD 17.31 billion by 2030 from USD 11.41 billion in 2025, at a CAGR of 8.7% from 2025 to 2030. The services NDT and inspection market is growing rapidly as industries prioritize asset integrity, safety compliance, and uptime across increasingly complex infrastructures. The rising adoption of predictive and condition-based maintenance is prompting operators to rely more on advanced and recurring inspection services. Digital transformation, facilitated by automated UT, digital radiography, drones, and analytics platforms, is further accelerating demand by enabling faster and more accurate defect detection. Additionally, aging industrial assets and stricter regulatory frameworks are driving long-term service requirements across energy, manufacturing, transportation, and public infrastructure sectors.

KEY TAKEAWAYS

-

BY REGIONBy region, North America is expected to dominate the market with a share of 34.5% in 2025.

-

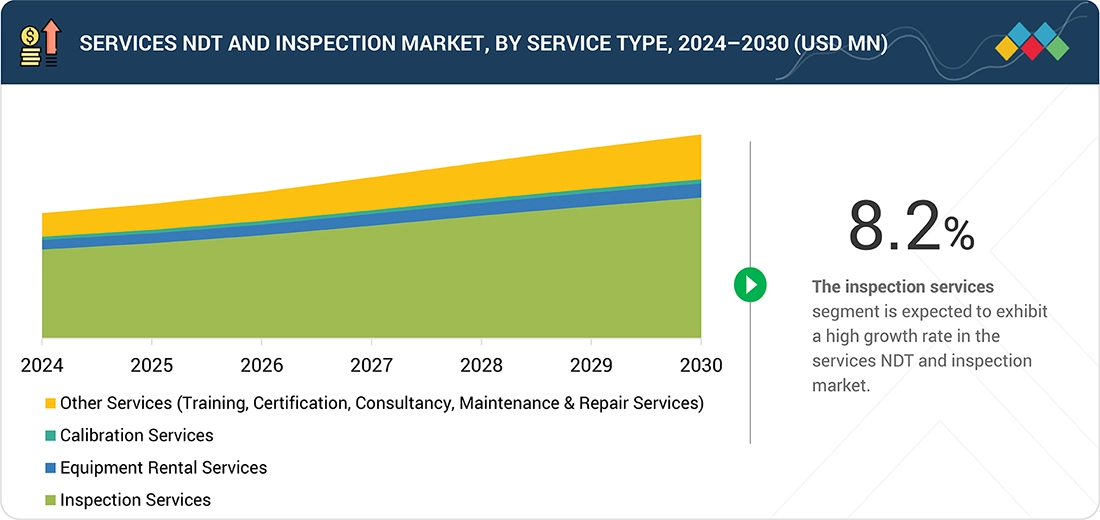

BY SERVICEBy service, the inspection services segment is expected to lead the market with a share of 70.7% in 2025.

-

BY VERTICALBy vertical, the aerospace segment is expected to exhibit the highest CAGR of 11.6% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSSGS Société Générale de Surveillance SA and Applus+ were identified as some of the star players in the services NDT and inspection market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESFPrimeC Solutions and NDT Global, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

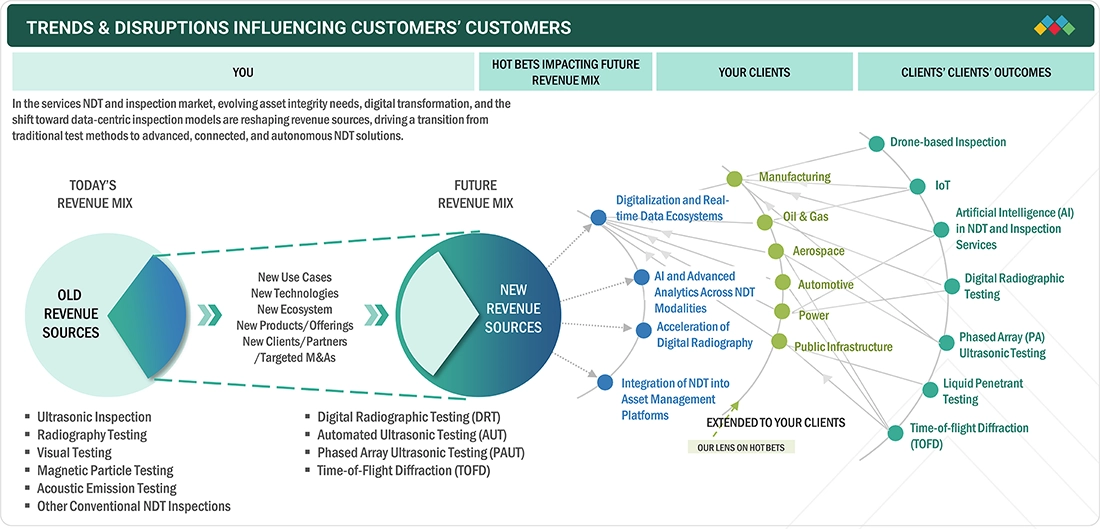

Key trends in the services NDT and inspection market include the rapid shift toward digital and automated inspection methods such as PAUT, TOFD, drones, and robotics to improve accuracy and safety. Service providers are increasingly adopting AI-driven analytics and centralized digital reporting platforms to enhance defect interpretation and streamline their decision-making processes. Remote inspection and continuous monitoring models are gaining traction as industries move toward predictive maintenance. Additionally, customers are demanding integrated integrity management services, reshaping the market toward long-term, data-centric service partnerships.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rapid digitalization, increasing asset complexity, and the shift toward predictive maintenance are redefining how customers manage integrity and operational risk. Automated, robotic, and drone-based inspections are reducing downtime and enhancing coverage in hazardous or inaccessible areas. AI-driven analytics and digital radiography are accelerating defect interpretation and enabling data-centric decision-making. Additionally, real-time monitoring through IoT ecosystems is disrupting traditional periodic inspection models by moving customers toward continuous, condition-based maintenance strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift Toward Predictive and Condition-based Maintenance

-

Increasing Demand for Compliance, Certification, and Asset Integrity Services

Level

-

Shortage of Certified and Experienced NDT Service Technicians

-

Inconsistent Service Quality Due to Fragmented Provider Ecosystem

Level

-

Growth of Remote Inspection, Monitoring, and Digital Reporting Services

-

Rising Outsourcing of Integrity Management to Third-party Service Providers

Level

-

Data Management and Interpretation Complexity in Digital Inspection Environments

-

High Operational Risk Exposure for Service Providers in Hazardous Sites

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift Toward Predictive and Condition-based Maintenance

Industries are moving away from periodic inspections toward continuous and predictive maintenance models to minimize downtime. This shift increases the need for high-frequency, specialized NDT services and remote inspection support. Clients increasingly rely on service providers to interpret data and validate asset condition, thereby strengthening long-term service contracts. As a result, NDT providers gain higher recurring revenue and deeper operational involvement.

Restraint: Shortage of Certified and Experienced NDT Service Technicians

The services market depends heavily on qualified Level II/III technicians, but global availability is limited. Advanced modalities, digital workflows, and complex assets require multidisciplinary expertise that many service providers struggle to maintain. This creates scheduling delays, increases service costs, and limits the scalability of high-demand techniques. Customers often face variability in service timelines and inspection reliability due to workforce constraints.

Opportunity: Growth of Remote Inspection, Monitoring, and Digital Reporting Services

Clients are increasingly adopting remote visual inspection, drone-based assessments, and sensor-enabled continuous monitoring to reduce downtime and improve safety. These models transition NDT from one-time fieldwork to ongoing, digitally delivered service engagements. Service providers can build long-term contracts by offering data interpretation, alerts, and asset-health dashboards. This creates a scalable, higher-value service ecosystem beyond traditional manual inspections.

Challenge: Data Management and Interpretation Complexity in Digital Inspection Environments

As inspections become more digital, service providers must process large volumes of imaging, ultrasonic, and sensor data. Many lack standardized workflows, integrated software, or AI-assisted interpretation tools, leading to inconsistencies and delays. Customers expect fast, accurate reporting, but manual data handling increases error risk. This challenge pressures service providers to invest in analytics capabilities and digital platforms to stay competitive.

SERVICES NDT AND INSPECTION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SGS delivered large-scale NDT and inspection services for oil & gas, power, and infrastructure projects across the Asia Pacific and the Middle East. The company deployed advanced PAUT, TOFD, digital radiography, corrosion mapping, and remote visual inspection services using drones and robotics. SGS integrated digital reporting suites and real-time data platforms to support asset integrity management across construction, shutdown, and maintenance cycles. | Improved detection accuracy and reduced turnaround time for critical inspections. Clients gained better project predictability through digitally documented workflows and reduced re-inspection cycles. Safety performance improved due to reduced human exposure in hazardous inspection zones, while operators benefited from higher-quality weld assessments and insights into structural integrity. |

|

Bureau Veritas executed multi-modal NDT programs for offshore platforms, LNG terminals, and industrial facilities, combining automated UT, digital RT, phased-array inspection, tank floor scanning, and corrosion detection services. Its digital platform—integrated with field sensors—enabled remote oversight, data trending, and predictive analytics to optimize asset lifecycle maintenance. | Enhanced reliability of integrity assessments through standardized inspection procedures and advanced analytics. Operators reduced downtime and maintenance costs by shifting from reactive to condition-based inspections. The integrated digital environment provided traceable reporting, lower risk exposure, and improved regulatory compliance across aging and high-risk assets. |

|

Applus+ delivered specialized NDT services for pipelines, petrochemical complexes, and renewable energy assets, integrating automated ultrasonic testing, digital weld inspection, guided wave testing, and drone-based visual evaluation. Their advanced service model included real-time data capture, centralized interpretation centers, and AI-assisted defect evaluation to accelerate decision-making. | Customers achieved higher accuracy in defect characterization and quicker validation of weld integrity across large assets. Automated workflows reduced manual interpretation errors and shortened inspection cycles. The use of remote inspection tools significantly enhanced safety compliance, while centralized analytics improved overall asset performance management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The services NDT and inspection market ecosystem is supported by upstream component suppliers and technology providers that enable advanced inspection modalities through sensors, instruments, and digital platforms. Service providers serve as the core operational layer, delivering specialized testing, integrity assessments, and asset monitoring across various industrial sectors. End-users, including manufacturing, energy, automotive, and infrastructure companies, rely on these services to ensure safety, compliance, and operational continuity. Together, this interconnected ecosystem drives a shift toward digital, automated, and data-centric inspection models.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Services NDT and Inspection Market, by Service

Inspection services remain the largest segment because industries increasingly rely on recurring, on-site integrity assessments to ensure safety, regulatory compliance, and uninterrupted operations. The complexity and aging profile of assets in oil & gas, power, manufacturing, and infrastructure sectors demand frequent, specialized inspection interventions. Additionally, the integration of advanced methods, such as PAUT, TOFD, and digital radiography, has elevated the value and scope of inspection services. As clients shift toward predictive maintenance models, inspection services become central to long-term asset management strategies.

Services NDT and Inspection Market, by Method

Volumetric inspection is expected to record the fastest CAGR because industries increasingly require a deeper, high-resolution assessment of internal defects in critical assets, especially in the oil & gas, aerospace, and power generation sectors. Advanced techniques such as PAUT, TOFD, digital RT, and CT scanning are being adopted to evaluate complex geometries, thick-walled components, and composite structures with greater accuracy. As asset integrity programs shift toward predictive maintenance, volumetric inspection becomes essential for detecting early-stage flaws that surface methods cannot capture. The growing use of automation and digital data analysis further accelerates demand for volumetric inspection services.

Services NDT and Inspection Market, by Vertical

The aerospace sector faces stringent safety and quality requirements, driving demand for high-precision NDT services across aircraft manufacturing, MRO activities, and composite material inspections. The accelerated adoption of lightweight composites, additive-manufactured components, and complex engine parts increases the intensity and frequency of inspections. Rising aircraft production rates, maintenance cycles, and fleet modernization programs further amplify service needs. These dynamics collectively position aerospace as the fastest-growing end-user segment for NDT and inspection services.

REGION

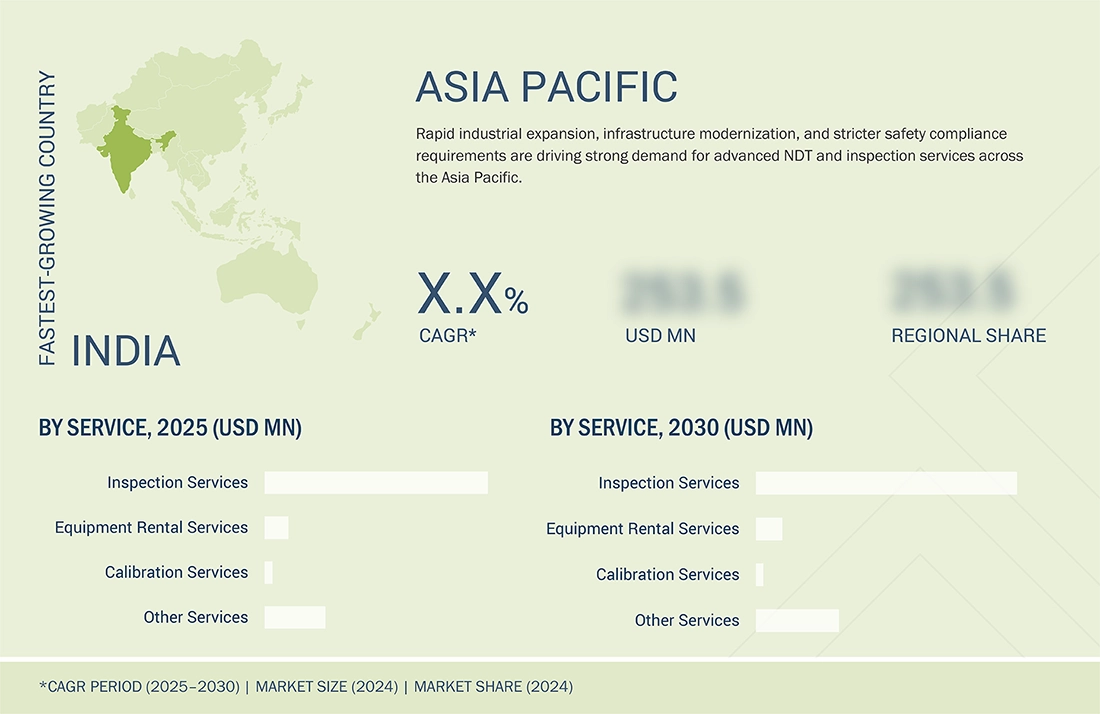

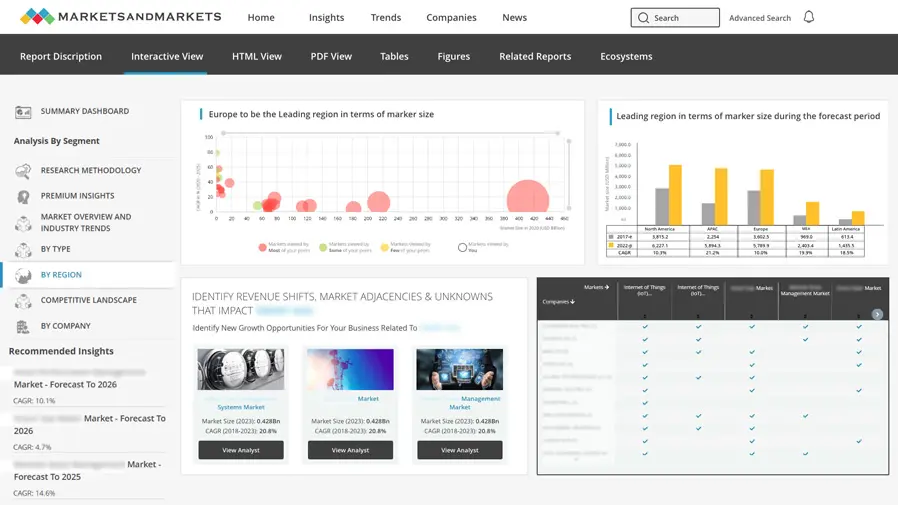

Asia Pacific is expected to be the fastest-growing region in the services NDT and inspection market during the forecast period

The Asia Pacific is projected to exhibit the fastest CAGR due to rapid industrialization, large-scale infrastructure development, and the expansion of energy, manufacturing, and transportation sectors. The region’s aging assets, combined with stricter safety and compliance regulations, are increasing the demand for recurring NDT and inspection services. Investments in petrochemicals, aerospace, and renewable energy are further driving the adoption of advanced inspection techniques. Additionally, the shift toward digital maintenance practices and the presence of cost-competitive service providers accelerate market growth in the region.

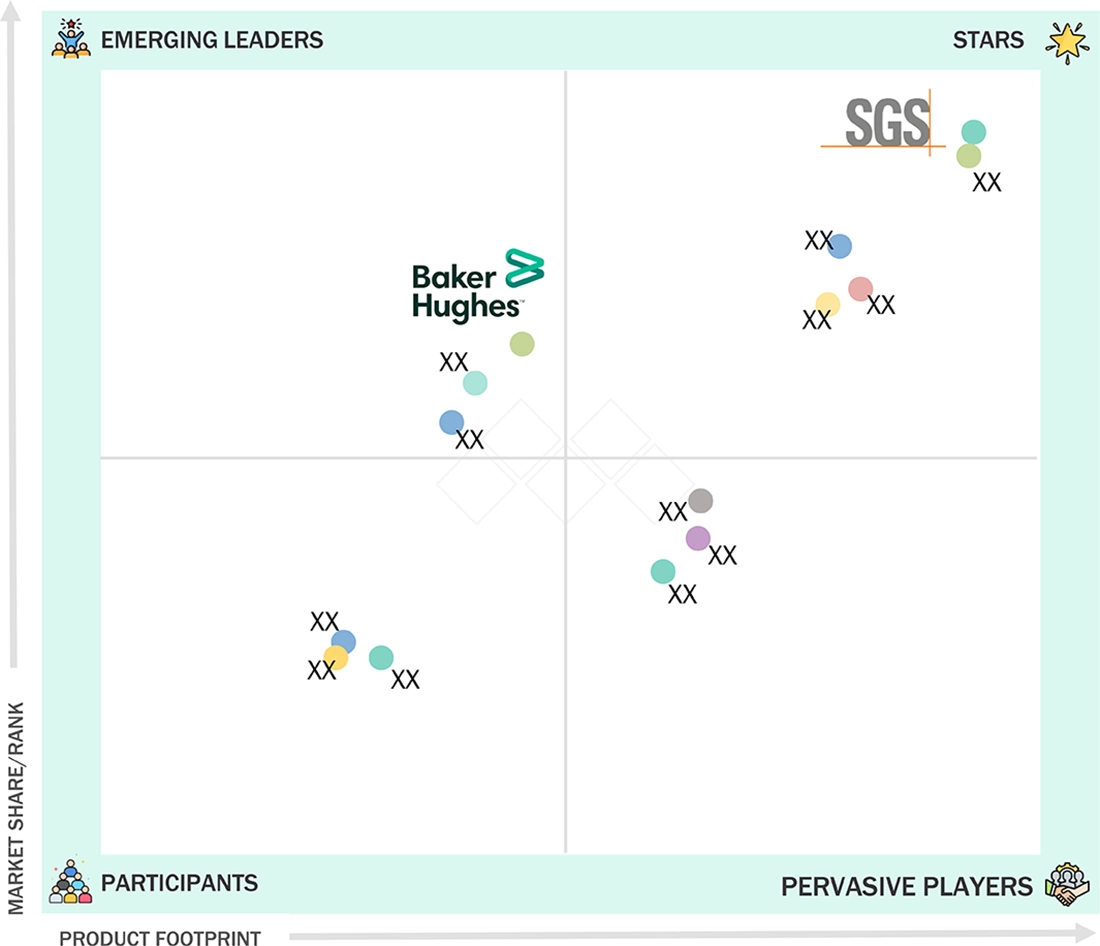

SERVICES NDT AND INSPECTION MARKET: COMPANY EVALUATION MATRIX

The matrix evaluates companies based on the breadth of their service portfolios and their influence in the services NDT and inspection market. SGS is positioned as a Star, reflecting its extensive service capabilities, strong regional presence, and consistent leadership across key industries. Baker Hughes is categorized as an Emerging Leader, supported by the rapid expansion of its advanced inspection service offerings and growing competitive strength. Together, these placements illustrate the differing maturity levels and growth pathways within the NDT and inspection services landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SGS Société Générale De Surveillance SA (Switzerland)

- Bureau Veritas (France)

- Baker Hughes Company (US)

- Applus+ (Spain)

- Intertek Group plc (UK)

- Element Materials Technology (UK)

- MISTRAS Group (US)

- Ashtead Technology (UK)

- TÜV Rheinland (Germany)

- DEKRA (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.62 Billion |

| Market Forecast in 2030 (Value) | USD 17.31 Billion |

| Growth Rate | CAGR of 8.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion/Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

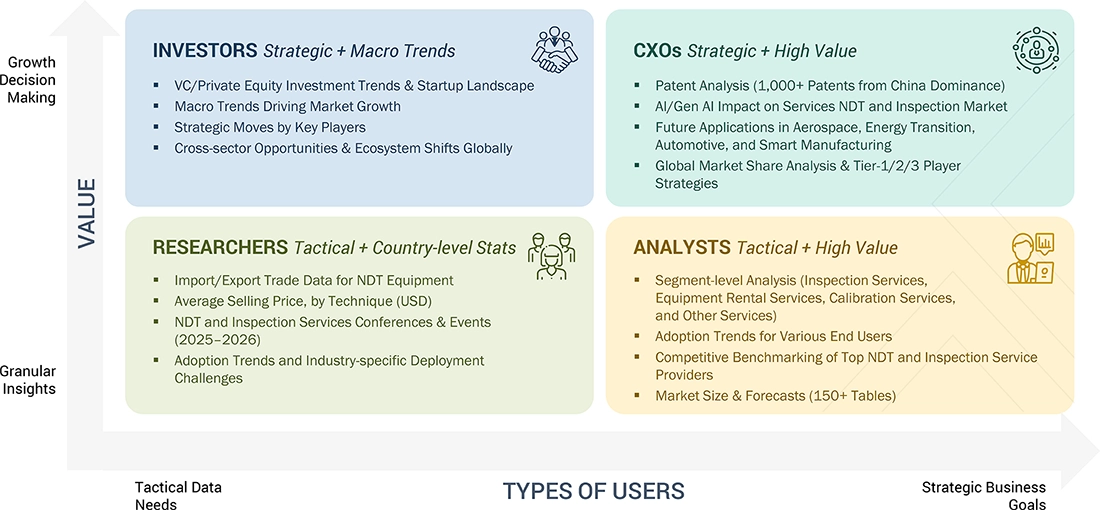

WHAT IS IN IT FOR YOU: SERVICES NDT AND INSPECTION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Automotive OEM |

|

|

| APAC Petrochemical Plant Operator |

|

|

| North American Aerospace OEM |

|

|

RECENT DEVELOPMENTS

- July 2025 : MISTRAS Group launched MISTRAS Data Solutions, a unified brand integrating its NDT and inspection-related software, sensors, and monitoring technologies to enhance data-driven asset integrity and predictive maintenance across critical industries.

- May 2025 : DEKRA Industrial, together with DEKRA Institute of Learning, expanded its NDT and inspection services across Southern Europe, the Middle East, and Africa, providing advanced inspection, material testing, asset integrity, corrosion control, rope-access inspections, vendor inspection, expediting services, vehicle mapping, and occupational training for high-risk industries. Certifications held include ISO 45001:2018 and DNV, enabling access to inspection opportunities in the nuclear and maritime sectors.

- April 2025 : Wabtec finalized the USD 1.78 billion acquisition of Evident's Inspection Technologies division, enhancing its Digital Intelligence business with advanced inspection solutions. The acquisition broadens Wabtec's portfolio in NDT, predictive maintenance, and automated inspection, expanding its TAM from USD 8 billion to USD 16 billion and strengthening its presence in rail, mining, and industrial sectors.

Table of Contents

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Services NDT and Inspection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Services NDT and Inspection Market