Automotive Testing Simulation Market - Global Forecast to 2025

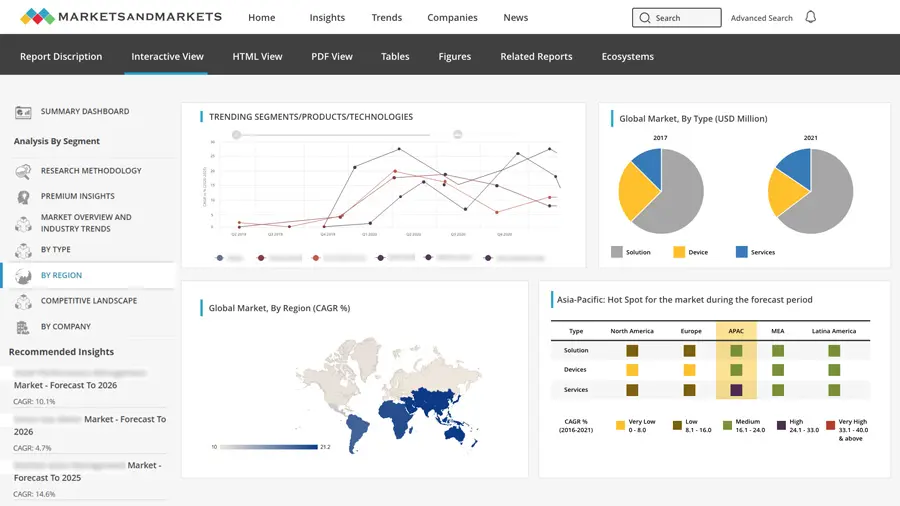

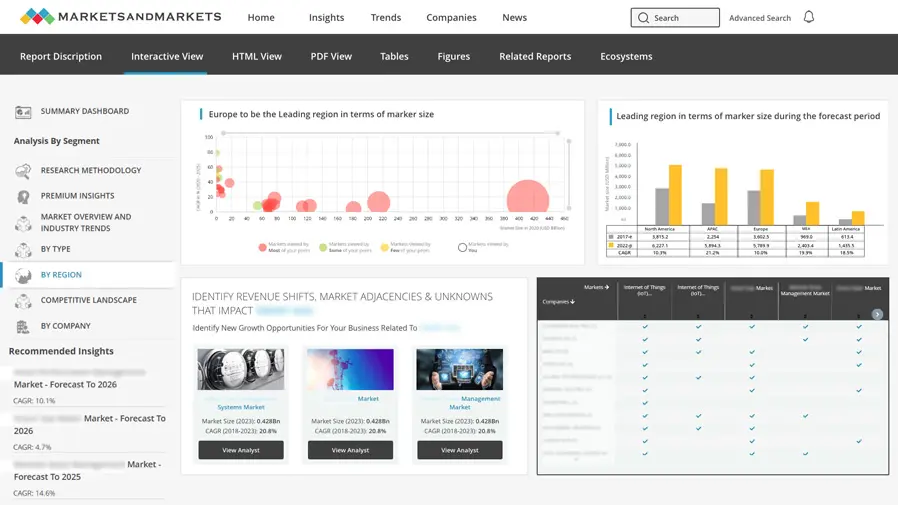

This study covers automotive testing simulation by system, by testing, by vehicle and by region. Although the automotive test and simulation is a conventional process and key part of vehicle manufacturing and prototyping, but, the method and technology have been altered dramatically every year due to requirement of high precision testing equipment. Today the testing and simulation is not only done for mechanical systems but also for software systems as well. Hence, testing simulators are equipped with innovative technologies to gain the advantages such as reduce product development limitations, cost effective testing, fast adaption with new safety and environmental regulations and react faster to market changes. The automotive testing simulation market is estimated to be the fastest growing for Asia Pacific region as the OEMs and tier I suppliers are expanding in the countries such as China and India.

Years considered for this report:

- 2016 - Base Year

- 2017 - Estimated Year

- 2020, 2022, 2025 - Forecast Period

Objectives of the Study:

- To segment and forecast the automotive testing simulation market size, by value and volume, based on system type, from 2017 to 2025.

- To segment the market for automotive testing simulation and forecast the market size, by volume and value, based on testing type, from 2017 to 2025.

- To segment the market for automotive testing simulation and forecast the market size, by volume and value, based on vehicle type, from 2017 to 2025.

- To segment and forecast the automotive testing simulation market size, by volume and value, based on region, from 2017 to 2025.

- The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the automotive testing simulation. The bottom-up approach has been used to estimate the market size, by volume. The market size, by volume, is multiplied by the average OE price (AOP) of simulator required for each system and the vehicle type to calculate the market size in terms of value. The summation of the country-wise market gives the regional market, and further summation of the regional market provides the global Automotive testing simulation.

The ecosystem of the automotive testing simulation market consists of manufacturers and Tier 1 suppliers such as Ansible Motion (UK), Cruden (The Netherlands), DALLARA (Italy), Mechanical Simulation (US), Moog (US), OKTAL (France), dSPACE (US), Bosch (Germany)

Target Audience

- Automobile organizations/associations

- Automotive original equipment manufacturers (OEM)

- Industry associations

- Raw material suppliers

- Testing simulation manufacturers

- Transport authorities

“The study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years (depends on a range of forecast period) for prioritizing their efforts and investments”

Scope of the Report

- Automotive testing simulation market, By System

- Engine System, By Region

- Transmission System, By Region

- Suspension System, By Region

- Electrical System, By Region

- Telemetry System, By Region

- Automotive testing simulation market, By Testing

- Emission Testing, By Region

- Vehicle Dynamics Testing, By Region

- Crash Testing, By Region

- Others (Mechanical, Hydraulic, Electrical and Acoustic Testing)

- Automotive testing simulation market, By Vehicle type

- PC, By Region

- LCV, By Region

- HCV, By Region

- (Vehicle type: Passenger car (PC), Light commercial vehicle (LCV), and heavy commercial vehicles (HCV))

- Automotive testing simulation market, By Region

- Asia Oceania

- Europe

- North America

- ROW

Tables of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.3.2 Currency

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Secondary Data

2.2 Primary Data

2.3 Factor Analysis

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.3 Macro Indicator

6 Automotive Testing Simulation, By System

6.1 Engine System

6.2 Transmission System

6.3 Suspension System

6.4 Electrical System

6.5 Telemetry System

7 Automotive Testing Simulation, By Material Type

7.1 Emission Testing

7.2 Vehicle Dynamic Testing

7.3 Crash Testing

7.4 Others (Mechanical, Hydraulic, Electrical and Acoustic Testing)

8 Automotive Testing Simulation, By Vehicle Type

8.1 PC

8.2 LCV

8.3 HCV

9 Automotive Testing Simulation, By Region and Country

9.1 Asia

9.1.1 China

9.1.2 Japan

9.1.3 India

9.1.4 South Korea

9.2 Europe

9.2.1 U.K.

9.2.2 Germany

9.2.3 France

9.2.4 Italy

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 RoW

9.4.1 Brazil

9.4.2 Russia

10 Competitive Landscape

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 New Product Developments

10.3.2 Mergers & Acquisitions

10.3.3 Partnerships/Supply Contracts/Collaborations/Jvs

10.3.4 Expansions

11 Company Profiles

11.1 Ansible Motion

11.2 Cruden Gobain

11.3 Dallara

11.4 Mechanical Simulation

11.5 Moog

11.6 Oktal

11.7 Dspace

11.8 Bosch

Growth opportunities and latent adjacency in Automotive Testing Simulation Market