COVID-19 Impact On Paints & Coatings Market by ResinType (Acrylic, Alkyed, Epoxy, Polyester, and Polyurethane), End-use Industry (Architecture (Professional and DIY) and Industrial), and Region - Global Forecast to 2025

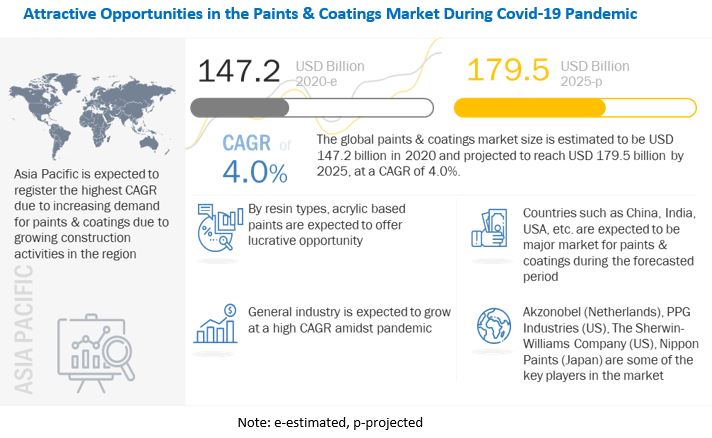

[114 Pages Report] The paints & coatings market size during the COVID-19 pandemic is projected to grow from USD 147.2 billion in 2020 to USD 179.5 billion by 2025, at a CAGR of 4.0% during the forecast period. Paints & coatings industry is impacted from shortage of subcontractors and raw materials, disruption in the supply chain, partial or suspended production, travel restriction, affecting demand from architectural, automotive, and aerospace sector. However, growing demand from construction and general industrial sector expected to drive demand for paints & coatings post Covid-19 Pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on paints & coatings market:

The COVID-19 pandemic had impacted the growth of the global paints & coatings market. From a regional point of view, the outbreak of COVID-19 has caused a major setback to the export-oriented economy of countries owing to the shutting down of manufacturing plants in the country. The construction sector is severely affected as social distancing, self-isolation, and city-wide lockdowns have forced many sites to stop construction across the world and construction sites, except those working on essential projects like hospitals. All this has impacted the overall paints & coatings consumption across all the countries.

Market Dynamics

Drivers: Growing demand for packaging paints & coatings from the food and beverage industry

Growing demand for packaged beverages products, such as fruit juice, energy drinks, nutritional drinks, nectars, ready to drinks tea and coffee, is driving the market of paints and coatings products. The demand from packaged food products such as frozen food, dairy products, meats, chicken, parcel foods, etc. is creating demand for food packaging coatings. The paints & coatings companies are diverting their resources to focus on coatings for food packaging industries. Packaging coatings are used to protect food & beverages, especially fresh food and processed meat. The demand for packaging coatings is on the rise amidst concerns over hygiene. E-commerce is known to consume more food and beverages packaging than goods generally sold offline. Due to lockdown and social distancing policies, people are ordering more through online channels, thus driving the demand for FMCG products. This, in turn, is generating demand for paints and coatings for protective food coatings.

Restraints: Shutdown of manufacturing facility

Non-operational manufacturing facilities, owing to the lockdown, are posing problems for paints & coatings companies. Many paints and coatings companies have manufacturing facilities in European and Asian countries, the epicenter of the pandemic. With the epicenter shifting to the US and Asian countries, paints and coatings companies are struggling to keep their facilities running with waning manpower. Manufacturing facilities across end-use industries have also shut down, leading to a decrease in demand for paints and coatings. Automotive, aerospace, and marine are the worst-hit industries due to the closure of their manufacturing facilities across the globe.

Acrylic resins based paints & coatings will have the highest growth in coming years

The acrylic resins paints & coatings segment is expected to lead the market during the forecast period. Acrylic-based paints and coatings are the least impacted due to its versatile nature and easy application in DIY projects.

General industry is one of the fastest-growing segments of the paints & coatings market amidst this pandemic

During the forecast period, the demand for residential buildings and the improvement of home remodeling/reconstruction in emerging economies such as India and China are projected to drive the general industry paints & coatings market.

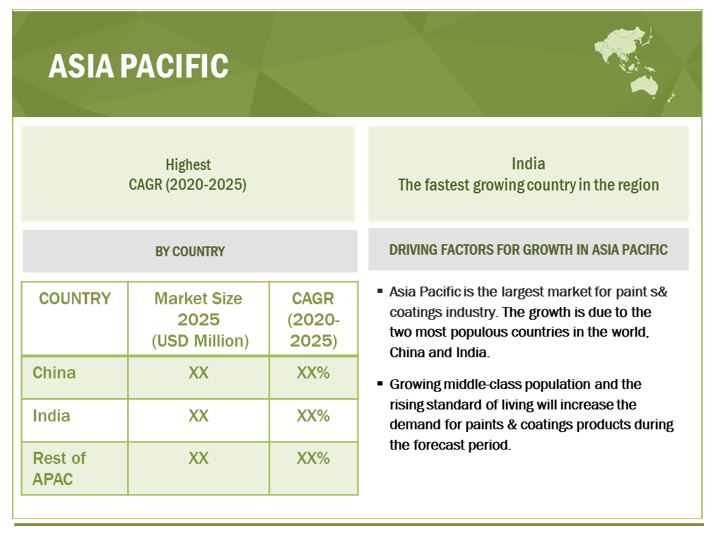

APAC is projected to be the largest paints & coatings market during the forecast period

Asia Pacific is the largest market for paints and coatings in the architecture segment in terms of volume and value due to an increase in numerous construction activities in China, India, which includes the construction of skyscrapers, bridges, and flyovers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players covered in the report are Akzonobel (Netherlands), PPG Industries (US), The Sherwin-Williams Company (US), Nippon Paints (Japan), Asian Paints Ltd (India), Axalta Coating Systems (US), Kansai Paint (Japan), BASF (Germany), RPM International (US) and Masco Corporation (US).

PPG Industries (US),

PPG’s global coatings businesses include paints, coatings, and specialty materials for the aerospace, architectural, automotive OEM, automotive refinish, industrial, packaging, and protective and marine markets, along with coatings services. The company’s Performance Coatings segment (aerospace, architectural coatings, automotive refinish; and protective and marine coatings businesses) comprised 59% of net sales, and its Industrial Coatings segment (automotive OEM coatings, coatings services, industrial coatings, packaging coatings, and specialty coatings and materials businesses) comprised 41% of net sales in 2018.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020-2025 |

|

Units considered |

Value (USD) and Volume (KILOTON) |

|

Segments |

Resins Type, End-Use Industry, and Region |

|

Regions |

APAC, Europe, North America, and RoW |

|

Companies |

Akzonobel (Netherlands), PPG Industries (US), The Sherwin-Williams Company (US), Nippon Paints (Japan), Asian Paints Ltd (India), Axalta Coating Systems (US), Kansai Paint (Japan), BASF (Germany), RPM International (US) and Masco Corporation (US) |

This research report categorizes the paints & coatings market based on resins type, end-use industry and region

Paint and Coating Market, by Resins Type

- Acrylic

- Alkyed

- Epoxy

- Polyester

- Polyurethane

- Others

Paint and Coating Market, by End-Use Industry

- Architecture

- Professional Architecture

- DIY Architecture

- Industrial

- General Industrial

- Automotive

- Protective

- Aerospace

- Packaging

- Wood

Paint and Coating Market, by Region

- APAC

- Europe

- North America

- Rest of the World

Recent Developments

PPG and the PPG Foundatin has contributed more than USD 1.5 million to organizations supporting immediate community relief efforts and emerging recovery needs, amid the impacts of the COVID-19 crisis. In addition to financial contributions, PPG has committed a variety of in-kind supply donations, including paint and masks, totaling more than USD 500,000. The company also donated more than 290 gallons (1,100 liters) of MASTER’S MARK anti-bacterial interior latex coatings to Shanghai Tong Ren Hospital.

Frequently Asked Questions (FAQ):

Which are the major end-use industries are top gainer in paints & coatings market during the pandemic?

The general industry have register positive growth during the pandemic followed by architectural paints & coatings market.

Which are the major companies in the paints & coatings market?

The paints & coatings market was dominated by Akzonobel (Netherlands), PPG Industries (US), The Sherwin-Williams Company (US), Nippon Paints (Japan), Asian Paints Ltd (India), Axalta Coating Systems (US), Kansai Paint (Japan), BASF (Germany), RPM International (US) and Masco Corporation (US).

Which are the leading countries in the paints & coatings market?

APAC is expected to grow at the highest CAGR by 2026. Countries such China, India are expected to be the major contributors to the market in APAC. China and India, which collectively account for more than 35% of the world’s population. The growing middle-class population and the rising standard of living will increase the demand for paints & coatings products during the forecast period

Which are the leading technology is expected to witness significant demand for paints & coatings in the coming years?

COVID-19 virus can survive for up to 72 hours on surfaces made of plastic and stainless steel. This has led to a rising interest in antimicrobial coatings for frequently touched surfaces such as door handles, shopping carts, elevator buttons, and handrails. To decrease the risk of touch contamination, antimicrobial paints & coatings have been used in hospitals, schools, food and drink processing amenities, electrical applications, fishery and agricultural equipment, and public venues.

What are the short-term strategies adopted by the key players to tackle the adverse impact of Covid 19?

COVID-19 pandemic has adverse impact on the paints & coatings market. Companies are focusing on serving the essential goods sector that includes food and beverages, medical and healthcare supplies, household cleaners, and other products. They are also focusing on volume over variety by producing specific kinds of paints and coatings for faster turnaround. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 15)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET SCOPE

1.2.1 MARKET DEFINITION

1.3 MARKETS COVERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 MARKET INCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1.1 Market size estimation methodology

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 MACROECONOMIC: IMPACT OF COVID-19 (Page No. - 29)

4.1 COVID-19 HEALTH ASSESSMENT

4.2 COVID-19 ECONOMIC ASSESSMENT

4.2.1 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

5 COVID-19 IMPACT ON PAINTS & COATINGS INDUSTRY (Page No. - 37)

5.1 VALUE CHAIN OF THE PAINTS & COATINGS INDUSTRY

5.2 IMPACT ON VALUE CHAIN

5.2.1 RAW MATERIALS/SUPPLIERS

5.2.2 PAINTS AND COATINGS FORMULATORS

5.2.3 APPLICATORS

5.2.4 DISTRIBUTORS

5.2.5 END-USE INDUSTRIES

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Growing demand for packaging paints and coatings from food and beverages industry

5.3.1.2 Rising awareness about antimicrobial paints and coatings

5.3.2 RESTRAINTS

5.3.2.1 Shutdown of manufacturing facilities

5.3.2.2 Non-availability of raw materials

5.3.2.3 Impact on supply chain and logistic

6 CUSTOMER ANALYSIS (Page No. - 47)

6.1 SHIFT IN AUTOMOTIVE INDUSTRY

6.1.1 DISRUPTION IN THE INDUSTRY

6.1.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/ IMPROVE PRODUCTION

6.1.2.1 Impact on customers’ revenues

6.1.2.2 Customer’s most impacted regions

6.1.2.3 Short-term strategies to manage cost structure and supply chains

6.1.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

6.1.3.1 Measures taken by customers

6.1.3.2 Customers’ perspective on the growth outlook

6.2 SHIFT IN AEROSPACE INDUSTRY

6.2.1 DISRUPTION IN THE INDUSTRY

6.2.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

6.2.2.1 IMPACT on CUSTOMERS’ REVENUES

6.2.2.2 Customer’s most impacted regions

6.2.2.3 Short-term strategies to manage cost structure and supply chains

6.2.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

6.2.3.1 Measures taken by customers

6.2.3.2 Customers’ perspective on growth outlook

6.3 SHIFT IN CONSTRUCTION INDUSTRY

6.3.1 DISRUPTION IN THE INDUSTRY

6.3.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

6.3.2.1 Impact on customers’ revenues

6.3.2.2 Customer’s most impacted regions

6.3.2.3 Short-term strategies to manage cost structure and supply chains

6.3.3 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

6.3.3.1 Measures taken by customers

6.3.3.2 Customers’ perspective on growth outlook

7 IMPACT OF COVID-19 ON PAINTS & COATINGS COMPANIES (Page No. - 57)

7.1 BIGGEST GAINERS, BY TOP END-USE INDUSTRIES

7.1.1 PACKAGING

7.1.2 DIY PAINT AND COATING

7.2 BIGGEST LOSERS, BY TOP END-USE INDUSTRIES

7.2.1 AUTOMOTIVE

7.2.2 PROFESSIONAL CONSTRUCTION

7.2.2.1 Professional paints & coatings

7.2.3 AEROSPACE

7.3 BIGGEST GAINERS, BY TOP TECHNOLOGIES

7.3.1 ANTIMICROBIAL COATING

7.3.2 PVC COATING FOR HEALTHCARE APRON

7.4 BIGGEST LOSERS, BY TOP TECHNOLOGIES

7.4.1 WATERBORNE ACRYLICS

7.4.2 SOLVENT BORNE POLYURETHANE AND EPOXY

7.5 COVID-19 IMPACT ON TOP COMPANIES

7.5.1 AKZONOBEL (NETHERLANDS)

7.5.2 PPG INDUSTRIES (US)

7.5.3 SHERWIN WILLIAMS COMPANY (USA)

7.5.4 AXALTA COATING SYSTEM LLC (USA)

7.5.5 NIPPON PAINTS (JAPAN)

7.5.6 ASIAN PAINTS LTD (INDIA)

7.5.7 KANSAI PAINT (JAPAN)

7.5.8 RPM INTERNATIONAL (USA)

7.5.9 MASCO CORPORATION (USA)

7.5.10 BASF (GERMANY)

8 STRATEGIES OF PAINTS AND COATINGS COMPANIES AND COVID-19 IMPACT (Page No. - 64)

8.1 IMPACT ON PAINTS & COATINGS COMPANIES PORTFOLIO

8.1.1 PRODUCT

8.1.2 APPLICATION

8.1.3 TECHNOLOGY

8.1.4 REGION

8.1.5 SHORT-TERM STRATEGIES (2020-2021)

8.1.6 MID-TERM STRATEGIES (2021-2022)

8.1.7 LONG-TERM STRATEGIES (2022 ONWARD)

8.2 COVID-19 RELATED DEVELOPMENTS/STRATEGIES OF STAKEHOLDERS IN THE PAINTS AND COATINGS VALUE CHAIN

9 IMPACT OF COVID-19 ON THE PAINTS & COATINGS MARKET (Page No. - 69)

9.1 SCENARIO-BASED FORECASTING, BY RESIN TYPE

9.1.1 PESSIMISTIC SCENARIO

9.1.2 REALISTIC SCENARIO

9.1.3 OPTIMISTIC SCENARIO

9.2 BY RESIN TYPE, IN REALISTIC SCENARIO

9.2.1 ACRYLIC

9.2.2 ALKYD

9.2.3 EPOXY

9.2.4 POLYESTER

9.2.5 POLYURETHANE

9.2.6 OTHERS

9.3 SCENARIO-BASED FORECASTING, BY END-USE INDUSTRY

9.3.1 PESSIMISTIC SCENARIO

9.3.2 REALISTIC SCENARIO

9.3.3 OPTIMISTIC SCENARIO

9.4 BY END-USE INDUSTRY, IN REALISTIC SCENARIO

9.4.1 ARCHITECTURE

9.4.1.1 Professional architecture

9.4.1.2 DIY architecture

9.4.2 INDUSTRIAL

9.4.2.1 General industrial

9.4.2.2 Automotive

9.4.2.3 Protective

9.4.2.4 Aerospace

9.4.2.5 Packaging

9.4.2.6 Wood

9.5 SCENARIO-BASED FORECASTING, BY REGION

9.5.1 PESSIMISTIC SCENARIO

9.5.2 REALISTIC SCENARIO

9.5.3 OPTIMISTIC SCENARIO

9.6 BY REGION, IN REALISTIC SCENARIO

9.6.1 GLOBAL

9.6.2 ASIA PACIFIC

9.6.2.1 China

9.6.2.2 India

9.6.2.3 Rest of Asia Pacific

9.6.3 EUROPE

9.6.3.1 Italy

9.6.3.2 Germany

9.6.3.3 SPAIN

9.6.3.4 UK

9.6.3.5 RUSSIA

9.6.3.6 Rest of Europe

9.6.4 NORTH AMERICA

9.6.4.1 US

9.6.4.2 Rest of North America

9.6.5 REST OF THE WORLD

9.6.5.1 REST OF THE WORLD

10 APPENDIX (Page No. - 110)

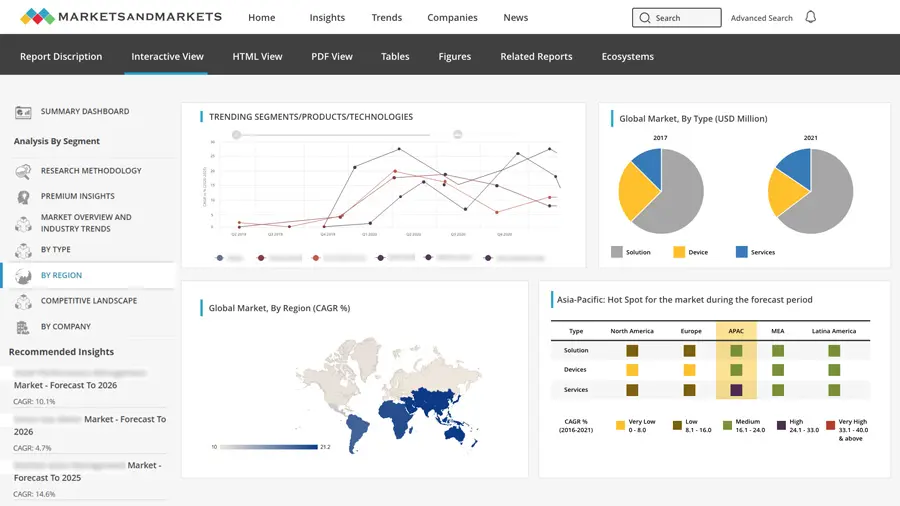

10.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

10.2 AVAILABLE CUSTOMIZATIONS

10.3 RELATED REPORTS

10.4 AUTHOR DETAILS

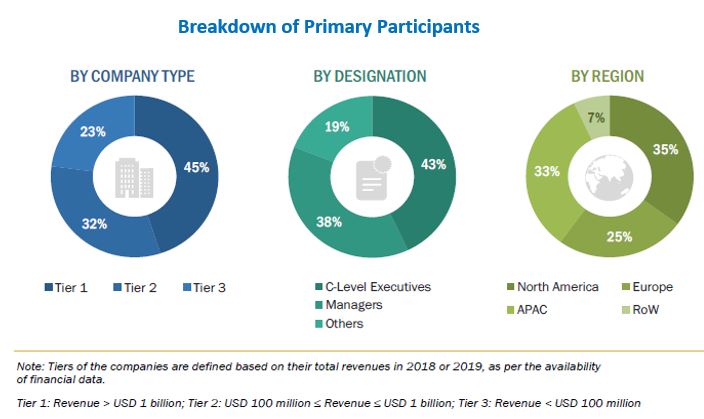

The study involved 4 major activities in estimating the current paints & coatings market size. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the paints and coating market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the traffic sensor market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply sides and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as marketing directors, consultants, managers, and related key executives from major companies and organizations operating in the market. The primary sources from the demand side included lab technicians, technologists, and sales/purchase managers from end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total impact on the size of the paints & coatings market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All the percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the paints & coatings market on the basis of resin type, end-use industries, and Geography

- To provide detailed information about the major factors (drivers and challenges) influencing the trends in the paints & coatings market during the COVID-19 phase

- To define, segment, and project the size of the market on the basis of resin types and end-use industries

- To project the size of the market, with respect to four main regions: North America, Europe, Asia Pacific, and Rest of the world (RoW), with their key countries

- To analyze the impact of a prolonged pandemic on the supply-demand scenario of paints & coatings

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To examine the shift in revenue patterns of paints & coatings manufacturers in 2020 and their capabilities to address emerging demand during this global COVID-19 pandemic

- To analyze the change in short-term strategies of manufacturers and end-users in the paints & coatings market

- To track key developments of the companies in the context of the COVID-19 pandemic in the global paints & coatings industry COVID-19

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in COVID-19 Impact On Paints & Coatings Market