In Space Manufacturing Market by Product Technology (Perovskite Photovoltaics cell, Graphene and solid-state Lithium batteries, Exchange membrane cells, Traction motor, Hydrogen propulsion system, Insulin), End Use and Region - Global Forecast to 2040

Update:: 26.09.24

In Space Manufacturing Market Size & Growth

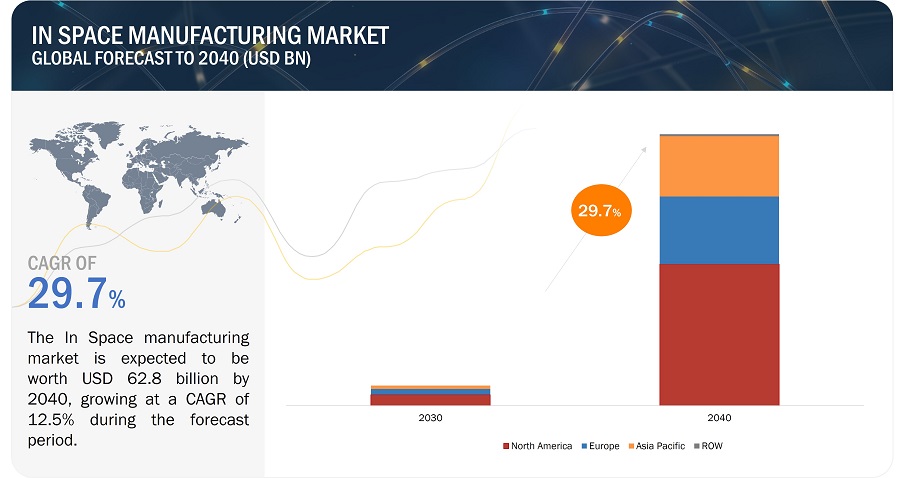

[197 Pages Report] The In Space Manufacturing Market size is estimated to be USD 4.6 billion in 2030 and is projected to reach USD 62.8 Billion by 2040, at a CAGR of 29.7% from 2030 to 2040. The primary driving factor for the growth of the In space manufacturing market is the development of key enabling technologies that allow manufacturing in space These include the miniaturization of hardware such as 3D printers, development of space robotics for remote assembly of components and energy efficient processes that allow low resource manufacturing. The development of such enabling technologies along with the trend of decreasing launch costs per kg observes in the previous years will help products to be manufactured at scale for use both in terrestrial markets as well as in space directly .

In Space Manufacturing Market Forecast to 2040

To know about the assumptions considered for the study, Request for Free Sample Report

In space manufacturing Market Trends

Driver: Manufacturing Advantages of In Space fabrication over terrestrial manufacturing

Space environments are well suited for manufacturing of electronics and advanced materials which require precision and near zero contamination. Microgravity reduces convection and sedimentation, resulting in a more homogeneous and purer environment. This particularly leads to higher-quality products with improved performance. Manufacturing of advanced materials in space can also take advantage of the unbounded crystal formation in space environment. In space, crystal growth is not impeded by buoyancy-driven convection, leading to larger, purer, and more uniform crystals. This is critical for industries such as electronics, optics, and materials science, where crystal quality is paramount. In 2022, Redwire- a space infrastructure company, sold its first space-grown optical crystal manufactured on its Industrial Crystallization Facility, which launched to the ISS in 2021. The sale of its space-manufactured optical crystal to researchers at the Center for Electron Microscopy and Analysis (CEMAS), a leading electron microscopy facility, at The Ohio State University with the sample being evaluated to be worth around $2 million per kilogram.

Restraint: Restricted production scale due to unavailability of key manufacturing raw materials

The absence of abundant Earth resources poses a unique obstacle. Traditional manufacturing relies on the accessibility of raw materials readily available on earth. This is a restriction for scalable production which requires a continuous supply of power, water and other resources. The current technology level for mining and extraction of other planets and well as refinement are still in the early stages. As such, plans for space habitats will still rely on the resupply missions from earth to the destination planet. The establishment of orbital outposts can reduce the number of launches required, however, the key restraint of being unable to completely utilize the available lunar or Martian resources will remain.

Opportunity: New market for in-space manufactured products for use in manned journeys and space habitats

Manned interplanetary missions, such as those to Mars, demand products that can withstand the rigors of deep space for extended durations. In space manufacturing companies can create specialized equipment and components designed for these missions. This includes reliable propulsion systems, radiation-resistant materials, advanced life support technologies, and robust communication equipment. By providing mission-critical products, these companies become integral to the success of long-duration space missions.

The New Space market for space-manufactured products targeted at space habitats and manned interplanetary missions represents an unparalleled opportunity for in-space manufacturing companies. By tailoring products to meet the unique needs of space environments, optimizing manufacturing processes, fostering sustainability, and embracing collaboration and innovation, these companies can position themselves as trailblazers in this transformative era of space exploration

Challenges: Long maturation timelines for key technologies in the space-based manufacturing ecosystem

The development of space-based manufacturing ecosystems requires the maturation of several key technologies such as prospecting and resource management, remote surveillance, power supply, replacements of components, repair and inspection. Additionally, since the components involving these systems have to be supplied from ear, significant amounts of refueling is required considering the payload mass and distance from the destination. As such, establishment of in-space refueling is expected to be another key component for the establishment of in-space manufacturing framework.

The challenges in achieving high TRL levels for space-based infrastructure are multifaceted and include space qualification of processes, reliability requirements, resource management an prototyping for space environment. Such stringent requirements are expected to impact the development timelines directly and require to be mitigated via partnerships, collaborations, miniaturization of hardware and advanced materials development for lighter components in 3D printers and robotic assemblies

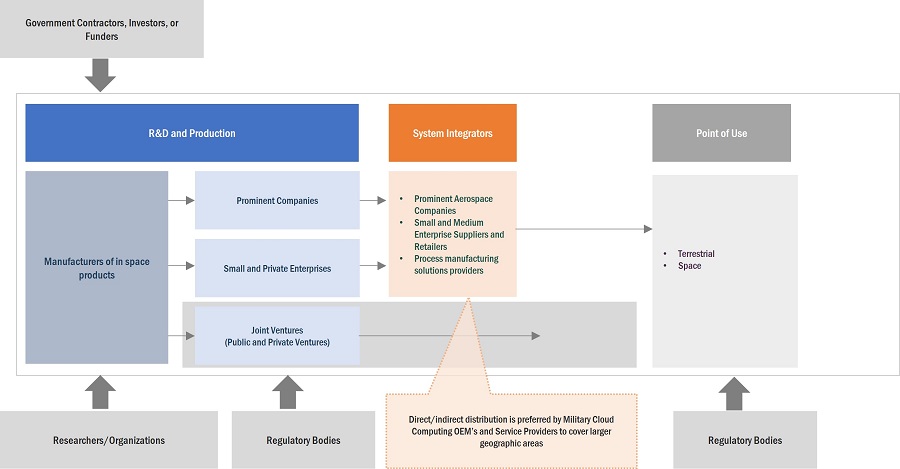

In Space Manufacturing Market Ecosystem

Allevi Inc. (US), Global Graphene Group, Inc. (US), Le Verre Fluore Fiber Solutions(France),Nedstack Fuel cell Technology BV (Netherlands) and Echodyne Corporation(US) are some of the leading companies in the in space manufacturing market.

In Space Manufacturing Market Segmentation

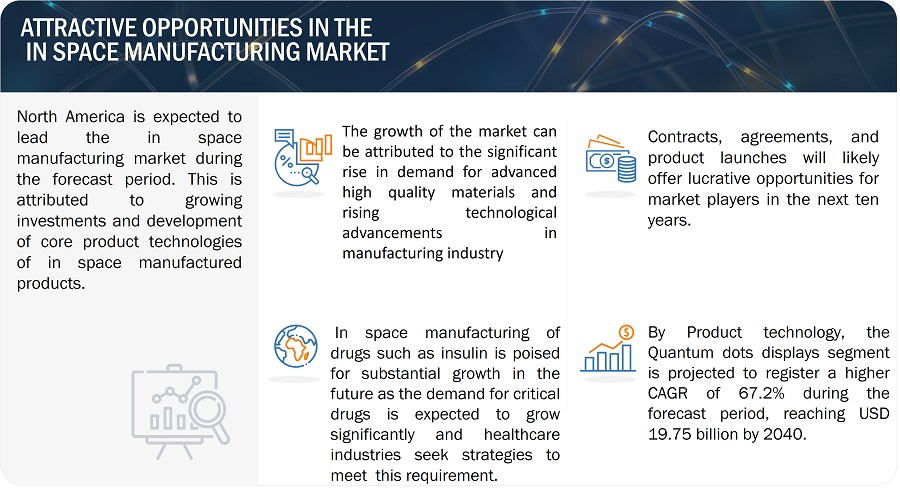

Based on product technology, Quantum dots display is expected to register the highest CAGR during the forecast period

Based on product technology, the in space manufacturing market has been segmented into 12 core sub-segments: Perovksite Photovoltaics cell,Graphene and solid-state Lithium batteries ,Proton Exchange membrane cells,Traction motor,Hydrogen propulsion system ,Insulin,Electromagnetic metamaterials antennas,Perfect spheres bearings,Quantum Dots Display,Tissue /organ,Zblan fiber optics,Zeolite crystal. The Quantum dots display segment is expected to register the highest CAGR during the forecast period attributed to the increasing adoption of Quantum LED displays which have higher quality output compared to traditional LEDs and current technologies.

In Space Manufacturing Market Regional Analysis

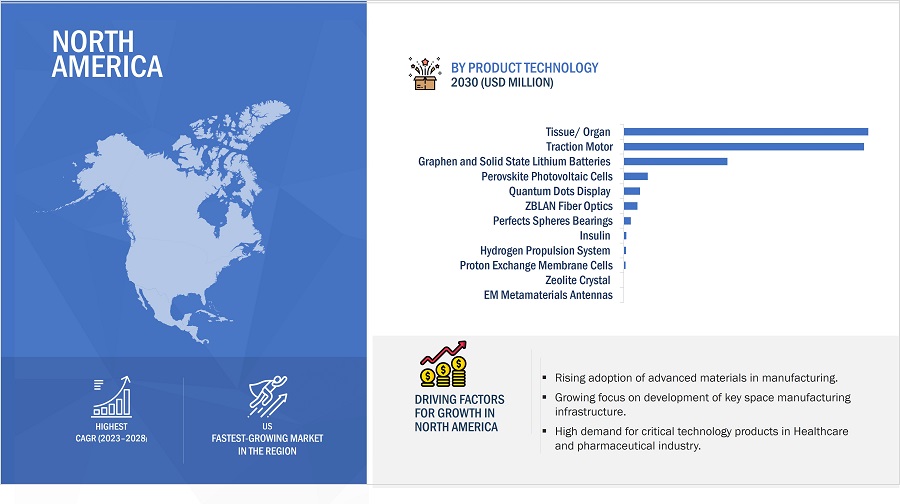

North America is expected to hold the highest market share in 2030.

North America is expected to hold the highest market share in 2030. The growth of the regional market can be attributed to the increasing demand for high quality materials fabricated in microgravity environments such as metamterial antennas, traction motors and ZBLAN fibers in key industries and research facilities . The rise in investments from key players to in the automation of manufacturing processes of these products is also expected to contribute to the growth of the regional market during the forecast period

In Space Manufacturing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top In Space Manufacturing Companies: Key Market Players

Allevi Inc. (US), Global Graphene Group, Inc. (US), Le Verre Fluore Fiber Solutions(France),Nedstack Fuel cell Technology BV (Netherlands) and Echodyne Corporation(US) are some of the leading companies in the in space manufacturing companies. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific and Rest of the World.

In Space Manufacturing Market Report Scope

|

Report Metric |

Details |

|

Estimated Value

|

USD 4.6 billion in 2030 |

|

Projected Value |

USD 62.8 billion by 2040 |

|

Growth Rate (CAGR) |

CAGR of 29.7% |

|

Market size available for years |

2030-2040 |

|

Base year considered |

2030 |

|

Forecast period |

2030-2040 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Product Technology |

|

Geographies covered |

North America, Asia Pacific, Europe, and RoW (Rest of the World) |

|

Companies covered |

Oxford Photovoltaics Ltd.(UK), QuantumScape Corporation(US), Echodyne Corporation(US), Siemens AG(Germany) and few others. |

In Space Manufacturing Market

Highlights

This research report categorizes the In Space Manufacturing market based on applications, industry, type, and solution

|

Segment |

Subsegment |

|

By Product Technology |

|

|

By End Use |

|

|

By Point of Use |

|

|

By Region |

|

Recent Developments

- In July 2023, NedStack BV announced a strategic partnership with AVL to commercialize Nedstack’s upcoming proton exchange membrane cell (PEMC) 3rd gen stack platform with plans for large scale manufacturing.

- In May 2023, ABB acquired Siemens' low-voltage NEMA motor line, including severe duty and general-purpose motors expanding the offering of ABB's Motion business area

- In February 2022, Echodyne announced a strategic partnership with Northrop Grumman to integrate Echodyne's metamterial antennae based radar technology into select Northrop Grumman defense and security solutions.

Key Questions Addressed in the Report :

What is the current size of the In Space Manufacturing market?

orldResponThe In-Space manufacturing market is estimated to grow from USD 4.6 Billion in 2030 to USD 62.8 Billion by 2040, at a CAGR of 29.7% from 2030 to 2040. North America is estimated to account for the largest share of the In space manufacturing market in 2030.

What are the key sustainability strategies adopted by leading players operating in the In Space Manufacturing market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the In Space Manufacturing marketsAllevi Inc. (US), Global Graphene Group, Inc. (US), Le Verre Fluore Fiber Solutions(France),Nedstack Fuel cell Technology BV (Netherlands) and Echodyne Corporation(US) are some of the leading companies in the In Space Manufacturing Market.

What new emerging technologies and use cases disrupt the In Space Manufacturing market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of 3D printing and additive manufacturing technologies along with

Who are the key players and innovators in the ecosystem of the In Space Manufacturing Market?

Response: . Allevi Inc. (US), Global Graphene Group, Inc. (US), Le Verre Fluore Fiber Solutions(France),Nedstack Fuel cell Technology BV (Netherlands) and Echodyne Corporation(US).

Which region is expected to hold the highest market share in the In Space Manufacturing market?

Response: In 2030, North America is expected to hold the greatest market share for In Space Manufacturing during the forecast period, US is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advancements in additive manufacturing and 3D printing technologies- Manufacturing advantages of in-space fabrication over terrestrial manufacturing- Increasing momentum for space-based infrastructure by government agencies and private players- Decreasing launch costsRESTRAINTS- High costs involved in maturation of space-based manufacturing technologies- Restricted production scale due to unavailability of key manufacturing raw materialsOPPORTUNITIES- Need for in-space manufactured products for use in manned journeys and space habitats- New market for in-space services in expanding satellite constellationsCHALLENGES- Refinement and utilization of available resources for ISRU-based manufacturing processes- Long maturation timelines for key technologies in space-based manufacturing ecosystem

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 IN-SPACE MANUFACTURING MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSSPACE QUALIFICATION AND MINIATURIZATION OF 3D PRINTING TECHNOLOGYROBOTIC ASSEMBLY AND MANUFACTURING METHODS FOR SPACE HARDWAREMODULAR MANUFACTURING OF SPACECRAFT AND SATELLITE COMPONENTS

-

6.3 USE CASE ANALYSISUSE CASE 1: IN-SPACE MICROFABRICATIONUSE CASE 2: COBOTS AND AI ROBOTS FOR SPACE FACTORIESUSE CASE 3: ADVANCED BIO-INKS

-

6.4 IMPACT OF MEGATRENDSSOLAR PANEL MANUFACTURING FOR SATELLITESDEVELOPMENT OF MISSION EXTENSION VEHICLES

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PEROVSKITE PHOTOVOLTAIC CELLSPEROVSKITE CELLS TO ADDRESS DEMAND FOR SUSTAINABLE AND EFFICIENT SOLAR POWER SOLUTIONS

-

7.3 GRAPHENE AND SOLID-STATE LITHIUM BATTERIESGRAPHENE AND SOLID-STATE BATTERY TECHNOLOGY ADOPTION TO REDUCE DEPENDENCE ON TRADITIONAL BATTERIES

-

7.4 PROTON EXCHANGE MEMBRANE CELLS (PEMC)AUTOMATION OF LABOR-INTENSIVE PEMC MANUFACTURING PROCESSES TO STREAMLINE MANUFACTURING

-

7.5 TRACTION MOTORSPOWERFUL ELECTRIC DRIVES TO REPLACE TRADITIONAL MOTORS IN TRAINS

-

7.6 HYDROGEN PROPULSION SYSTEMSMICROGRAVITY ENVIRONMENT TO MITIGATE COMPLEX MANUFACTURING CHALLENGES

-

7.7 INSULININCREASING DEMAND FOR EXPENSIVE LIFE-SAVING DRUGS TO BE SUSTAINED BY IN-SPACE MANUFACTURING

-

7.8 ELECTROMAGNETIC METAMATERIAL ANTENNASLOW-RESOURCE MANUFACTURING OF ADVANCED ANTENNAS TO REDUCE TERRESTRIAL PRODUCTION COSTS

-

7.9 PERFECT SPHERE BEARINGSNEED FOR ACCURATE AND REAL-TIME TARGET INFORMATION TO ENHANCE MILITARY MISSION CAPABILITIES

-

7.10 QUANTUM DOT DISPLAYSPRECISION MANUFACTURING IN MICROGRAVITY ENVIRONMENT TO DRIVE ADOPTION OF HIGH-QUALITY DISPLAYS

-

7.11 TISSUES/ORGANSNOVEL MANUFACTURING PROCESSES TO ENABLE ORGAN AND TISSUE BIO-PRINTING

-

7.12 ZBLAN FIBER OPTICSSPACE FABRICATION OF HIGH-QUALITY OPTICAL FIBERS TO BE COST-EFFECTIVE

-

7.13 ZEOLITE CRYSTALSMICROGRAVITY CONDITIONS TO ENABLE HIGH-QUALITY ZEOLITE CRYSTAL PRODUCTION

- 8.1 INTRODUCTION

-

8.2 GOVERNMENT & MILITARYIN-SPACE MANUFACTURING TO ADDRESS DEMAND FOR REPAIR AND MAINTENANCE OF SPACE-BASED ASSETS AND IMPROVED MISSION FUNCTIONALITY

-

8.3 COMMERCIALINVESTMENTS IN SPACE ECONOMY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 SPACEIN-SPACE MANUFACTURING TO BE ADVANTAGEOUS FOR CONTINUED GROWTH OF NEW SPACE ECOSYSTEM

-

9.3 TERRESTRIALIN-SPACE PRODUCTS TO WITNESS INCREASED DEMAND IN FUTURE

- 10.1 INTRODUCTION

- 10.2 RECESSION IMPACT ON IN-SPACE MANUFACTURING MARKET

-

10.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increasing investment in new space economy to drive marketCANADA- Government incentives to develop advanced technologies for space exploration and mining to drive market

-

10.4 EUROPEPESTLE ANALYSIS: EUROPEUK- Collaborations between private and government entities to develop advanced material manufacturing processes to drive marketFRANCE- Favorable government policies and maturation of advanced technologies to drive marketGERMANY- Sizeable aerospace industries and strong investments in technology to drive marketRUSSIA- Diversification of technology products and development of advanced hardware to enable commercial viability of ISM products to drive marketITALY- Domestic space programs to drive market

-

10.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Strong government initiatives to increase contribution in all space programs to drive marketINDIA- Future space programs and increasing commercial players in space technology segment to drive marketJAPAN- Growing demand for drone services in agriculture, inspection, and entertainment to drive marketSOUTH KOREA- Growing demand for high-quality fibers and precision machined goods to drive market

-

10.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICA- Increasing applicability of drones in defense and commercial sectors to drive marketLATIN AMERICA- Emergence of new players in technology sector to drive market

- 11.1 INTRODUCTION

- 11.2 RANKING ANALYSIS

-

11.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.4 COMPANY FOOTPRINT

-

11.5 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

12.1 INTRODUCTIONOXFORD PHOTOVOLTAICS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsQUANTUMSCAPE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsNEDSTACK FUEL CELL TECHNOLOGY BV- Business overview- Products/Solutions/Services offered- Recent developmentsECHODYNE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsABB LTD.- Business overview- Products/Solutions/Services offeredSIEMENS AG- Business overview- Products/Solutions/Services offered3D BIOPRINTING SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsLE VERRE FLUORE FIBER SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsALLEVI- Business overview- Products/Solutions/Services offeredTHORLABS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsGLOBAL GRAPHENE GROUP, INC. (G3)- Business overview- Products/Solutions/Services offered- Recent developmentsFRACTAL ANTENNA SYSTEMS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHYPERSONIX LAUNCH SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsNOVO NORDISK A/S- Business overview- Products/Solutions/Services offered- Recent developmentsENECOAT TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsFOMS, INC.- Business overview- Products/Solutions/Services offered- Recent developments

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 IN-SPACE MANUFACTURING MARKET ECOSYSTEM

- TABLE 4 IN-SPACE MANUFACTURING MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF KEY PATENTS

- TABLE 10 IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030−2034 (USD MILLION)

- TABLE 11 IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 12 IN-SPACE MANUFACTURING MARKET, BY REGION, 2030–2034 (USD MILLION)

- TABLE 13 IN-SPACE MANUFACTURING MARKET, BY REGION, 2035–2040 (USD MILLION)

- TABLE 14 NORTH AMERICA: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2030–2034 (USD MILLION)

- TABLE 15 NORTH AMERICA: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2035–2040 (USD MILLION)

- TABLE 16 NORTH AMERICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 17 NORTH AMERICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 18 US: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 19 US: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 20 CANADA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 21 CANADA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 22 EUROPE: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2030–2034 (USD MILLION)

- TABLE 23 EUROPE: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2035–2040 (USD MILLION)

- TABLE 24 EUROPE: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 25 EUROPE: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 26 UK: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 27 UK: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 28 FRANCE: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 29 FRANCE: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 30 GERMANY: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 31 GERMANY: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 32 RUSSIA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 33 RUSSIA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 34 ITALY: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 35 ITALY: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 36 ASIA PACIFIC: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2030–2034 (USD MILLION)

- TABLE 37 ASIA PACIFIC: IN-SPACE MANUFACTURING MARKET, BY COUNTRY, 2035–2040 (USD MILLION)

- TABLE 38 ASIA PACIFIC: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 39 ASIA PACIFIC: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 40 CHINA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 41 CHINA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 42 INDIA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 43 INDIA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 44 JAPAN: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 45 JAPAN: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 46 SOUTH KOREA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 47 SOUTH KOREA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 48 REST OF THE WORLD: IN-SPACE MANUFACTURING MARKET, BY REGION, 2030–2034 (USD MILLION)

- TABLE 49 REST OF THE WORLD: IN-SPACE MANUFACTURING MARKET, BY REGION, 2035–2040 (USD MILLION)

- TABLE 50 REST OF THE WORLD: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 51 REST OF THE WORLD: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 52 MIDDLE EAST & AFRICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 53 MIDDLE EAST & AFRICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 54 LATIN AMERICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2030–2034 (USD MILLION)

- TABLE 55 LATIN AMERICA: IN-SPACE MANUFACTURING MARKET, BY PRODUCT TECHNOLOGY, 2035–2040 (USD MILLION)

- TABLE 56 KEY DEVELOPMENTS BY LEADING PLAYERS IN IN-SPACE MANUFACTURING MARKET, 2019–2023

- TABLE 57 COMPANY PRODUCT FOOTPRINT

- TABLE 58 COMPANY PRODUCT TECHNOLOGY FOOTPRINT (PEROVSKITE PHOTOVOLTAIC CELLS, TRACTION MOTORS, AND OTHERS)

- TABLE 59 COMPANY PRODUCT TECHNOLOGY FOOTPRINT (PERFECT SPHERE BEARINGS, TISSUES/ORGANS, AND OTHERS)

- TABLE 60 COMPANY REGIONAL FOOTPRINT

- TABLE 61 IN-SPACE MANUFACTURING MARKET: PRODUCT LAUNCHES, JANUARY 2019– DECEMBER 2023

- TABLE 62 IN-SPACE MANUFACTURING MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 63 IN-SPACE MANUFACTURING MARKET: EXPANSIONS, JANUARY 2019– DECEMBER 2023

- TABLE 64 OXFORD PHOTOVOLTAICS LTD.: COMPANY OVERVIEW

- TABLE 65 OXFORD PHOTOVOLTAICS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 66 OXFORD PHOTOVOLTAICS LTD.: OTHERS

- TABLE 67 QUANTUMSCAPE CORPORATION: COMPANY OVERVIEW

- TABLE 68 QUANTUMSCAPE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 69 QUANTUMSCAPE CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 70 QUANTUMSCAPE CORPORATION: DEALS

- TABLE 71 NEDSTACK FUEL CELL TECHNOLOGY BV: COMPANY OVERVIEW

- TABLE 72 NEDSTACK FUEL CELL TECHNOLOGY BV: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 73 NEDSTACK FUEL CELL TECHNOLOGY BV: PRODUCT DEVELOPMENTS

- TABLE 74 NEDSTACK FUEL CELL TECHNOLOGY BV: DEALS

- TABLE 75 ECHODYNE CORPORATION: COMPANY OVERVIEW

- TABLE 76 ECHODYNE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 77 ECHODYNE CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 78 ECHODYNE CORPORATION: DEALS

- TABLE 79 ABB LTD.: COMPANY OVERVIEW

- TABLE 80 ABB LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 ABB LTD.: DEALS

- TABLE 82 SIEMENS AG: COMPANY OVERVIEW

- TABLE 83 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 84 SIEMENS AG: DEALS

- TABLE 85 3D BIOPRINTING SOLUTIONS: COMPANY OVERVIEW

- TABLE 86 3D BIOPRINTING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 87 3D BIOPRINTING SOLUTIONS: PRODUCT DEVELOPMENTS

- TABLE 88 LE VERRE FLUORE FIBER SOLUTIONS: COMPANY OVERVIEW

- TABLE 89 LE VERRE FLUORE FIBER SOLUTIONS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 90 LE VERRE FLUORE FIBER SOLUTIONS: PRODUCT DEVELOPMENTS

- TABLE 91 LE VERRE FLUORE FIBER SOLUTIONS: DEALS

- TABLE 92 ALLEVI: COMPANY OVERVIEW

- TABLE 93 ALLEVI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 94 ALLEVI: DEALS

- TABLE 95 THORLABS, INC.: COMPANY OVERVIEW

- TABLE 96 THORLABS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 THORLABS, INC.: DEALS

- TABLE 98 GLOBAL GRAPHENE GROUP, INC. (G3): COMPANY OVERVIEW

- TABLE 99 GLOBAL GRAPHENE GROUP, INC. (G3): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 100 GLOBAL GRAPHENE GROUP, INC. (G3): PRODUCT DEVELOPMENTS

- TABLE 101 GLOBAL GRAPHENE GROUP, INC. (G3): DEALS

- TABLE 102 FRACTAL ANTENNA SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 103 FRACTAL ANTENNA SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 104 FRACTAL ANTENNA SYSTEMS, INC.: PRODUCT DEVELOPMENTS

- TABLE 105 HYPERSONIX LAUNCH SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 106 HYPERSONIX LAUNCH SYSTEMS LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 107 HYPERSONIX LAUNCH SYSTEMS LTD.: PRODUCT DEVELOPMENTS

- TABLE 108 HYPERSONIX LAUNCH SYSTEMS LTD.: DEALS

- TABLE 109 NOVO NORDISK A/S: COMPANY OVERVIEW

- TABLE 110 NOVO NORDISK A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 NOVO NORDISK A/S: DEALS

- TABLE 112 ENECOAT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 113 ENECOAT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 ENECOAT TECHNOLOGIES: DEALS

- TABLE 115 FOMS, INC.: COMPANY OVERVIEW

- TABLE 116 FOMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 FOMS, INC.: PRODUCT DEVELOPMENTS

- FIGURE 1 IN-SPACE MANUFACTURING MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

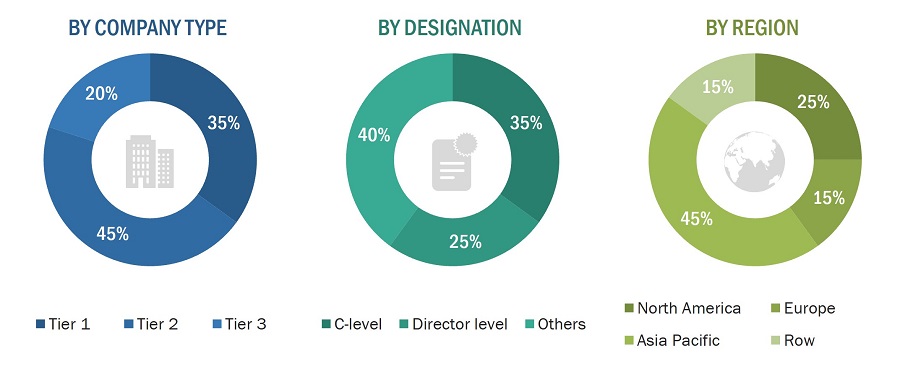

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 9 TISSUES/ORGANS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- FIGURE 10 QUANTUM DOT DISPLAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2040

- FIGURE 11 JAPAN TO BE FASTEST-GROWING MARKET FROM 2030 TO 2034

- FIGURE 12 JAPAN AND SOUTH KOREA TO BE FASTEST-GROWING MARKETS FROM 2035 TO 2040

- FIGURE 13 ADVANCEMENTS IN ADDITIVE MANUFACTURING AND 3D PRINTING TECHNOLOGIES TO DRIVE MARKET

- FIGURE 14 TISSUES/ORGANS SEGMENT TO DOMINATE MARKET BY 2030

- FIGURE 15 TRACTION MOTORS SEGMENT TO DOMINATE MARKET BY 2034

- FIGURE 16 QUANTUM DOTS DISPLAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2040

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL MARKET FROM 2030 TO 2034

- FIGURE 18 REST OF THE WORLD TO BE FASTEST-GROWING REGIONAL MARKET FROM 2035 TO 2040

- FIGURE 19 IN-SPACE MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VALUE CHAIN ANALYSIS OF IN-SPACE MANUFACTURING MARKET

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING IN-SPACE MANUFACTURING MARKET

- FIGURE 22 IN-SPACE MANUFACTURING MARKET ECOSYSTEM MAP

- FIGURE 23 IN-SPACE MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 QUANTUM DOT DISPLAYS SEGMENT TO REGISTER HIGHEST CAGR FROM 2030 TO 2034

- FIGURE 25 QUANTUM DOT DISPLAYS SEGMENT TO REGISTER HIGHEST CAGR FROM 2035 TO 2040

- FIGURE 26 NORTH AMERICA: IN-SPACE MANUFACTURING MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: IN-SPACE MANUFACTURING MARKET SNAPSHOT

- FIGURE 29 REST OF THE WORLD: IN-SPACE MANUFACTURING MARKET SNAPSHOT

- FIGURE 30 MARKET RANKING OF TOP 5 PLAYERS, 2023

- FIGURE 31 IN-SPACE MANUFACTURING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 ABB LTD.: COMPANY SNAPSHOT

- FIGURE 33 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 34 NOVO NORDISK A/S: COMPANY SNAPSHOT

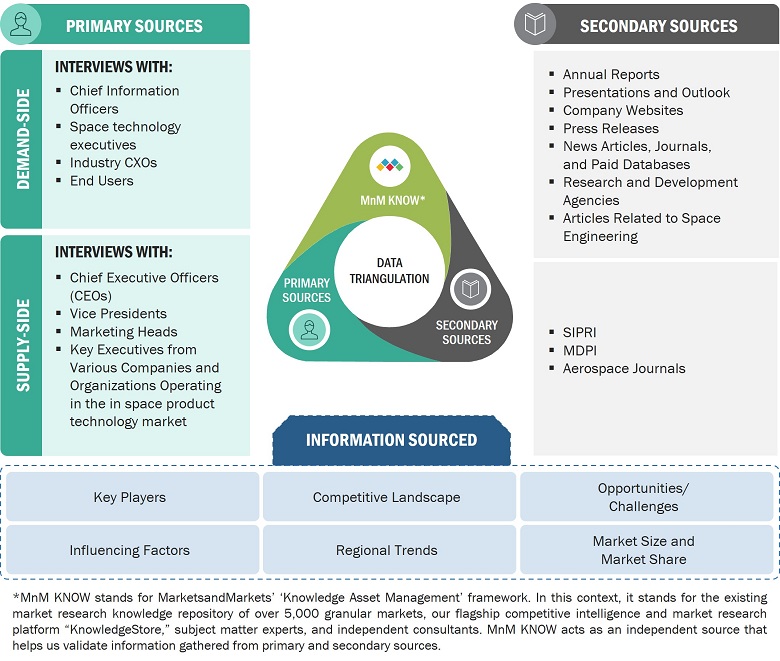

The research study conducted on the In Space Manufacturing market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek and Factiva to identify and collect information relevant to the In Space Manufacturing market. The primary sources considered included industry experts from the In space manufacturing market as well as sub-component manufacturers, 3D printing and additive manufacturing technology companies , government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the In Space Manufacturingmarket as well as to assess the growth prospects of the market. Sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), and directors from business development, marketing, and product development/innovation teams; related key executives from Siemens, Quantum Scape , Nedstack BV ; independent consultants; importers; and key opinion leaders.

Secondary Research

Secondary sources referred for this research study included the Factories in Space database, Multidisciplinary Digital Publishing Institute(MDPI) Journals, Aerospace manufacturing articles, and corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the in-space manufacturing market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the in-space manufacturing market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

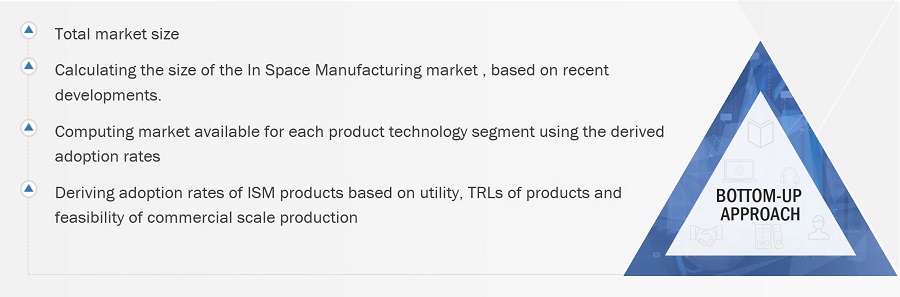

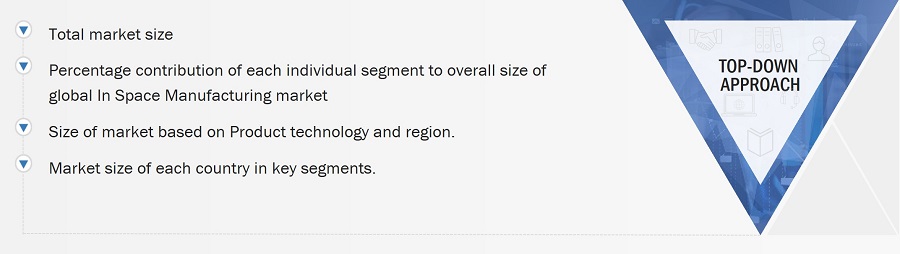

- The top-down and bottom-up approaches were used to estimate and validate the size of the In space manufacturing market. The research methodology used to estimate the market size also included the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by representatives in MarketsandMarkets, and presented in this report.

The top-down and bottom-up approaches were used to estimate and validate the size of the in-space manufacturing market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall size of the in-space manufacturing market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

In space manufacturing market refers to the market for finished and semi-finished products manufactured in space such as bio-printed tissues or organs, 3D printed components such as metamaterial antennas as well as advanced materials such as zeolite and insulin crystals in space. These products are expected to be manufactured in facilities present in orbit and used as components or products themselves in space or back on earth.

It is expected to be an emerging market with high growth potential due to the potential demand in the terrestrial market for high quality products manufactured in microgravity environments and their cost effectiveness for space based service providers.

Key Stakeholders

- Microfabrication manufacturers

- Subsystem manufacturers

- Defense organizations

- Pharmaceutical and drug manufacturers

- Space agencies

- Aerospace manufacturers

- Regulatory Bodies

- Research Centers

Report Objectives

- To define, describe, segment, and forecast the size of the in space manufacturing based on product technology, end use, point of use and region

- To forecast the size of market segments with respect to four regions, namely North America, Europe, Asia Pacific, and the Rest of the World, as well as major countries in these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To identify maritime industry trends, market trends, and technology trends prevailing in the market

- To provide an overview of the regulatory landscape for the adoption of maritime patrol aircraft

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To analyze competitive developments such as mergers & acquisitions, partnerships, agreements, and product developments

- To identify detailed financial positions, key products, and unique selling points of the leading market players

1 Micromarkets are referred to as the segments and subsegments of the In space manufacturing market considered in the scope of the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in In Space Manufacturing Market