Indian Bus Industry Market by Fuel Type, Geography (2016-2018)

Bus industry is one of the vital integral segments of Indian automobile industry. It is a common widespread public transport in India. The industry comprises of buses that are categorised into school buses, mini buses, tourist buses, deluxe buses, commuter buses and others depending on the use. Owing to the development of infrastructure and roads, connecting to remote places has become easier due to which more and more people are availing bus services. This has greatly contributed to the growth of bus industry. The growth in this market has stimulated the manufacturers towards more innovations. New buses have been introduced that are well equipped with advanced facilities and services such as passenger information system, air-conditioners, high quality engines, air suspension and transmission systems and others. With the increase in use of such buses over the next few years, the customer base is also expected to ascend at a high rate.

With respect to increase in commuter base, even the foreign companies such as Daimler, Mercedes and Volvo are making heavy investments in this segment of automobile industry in India. New standards of luxury and comfort have been set by these companies in tourister bus segment by providing high class and advanced air conditioned buses.

The major domestic players in the Indian bus industry are Ashok Leyland, Tata Motors, Swaraj Mazda and others. Hindustan Motors Ltd is the manufacturer of most of the custom made buses and school buses in India whereas Mahindra & Mahindra Ltd. is the chief manufacturer of mini buses.

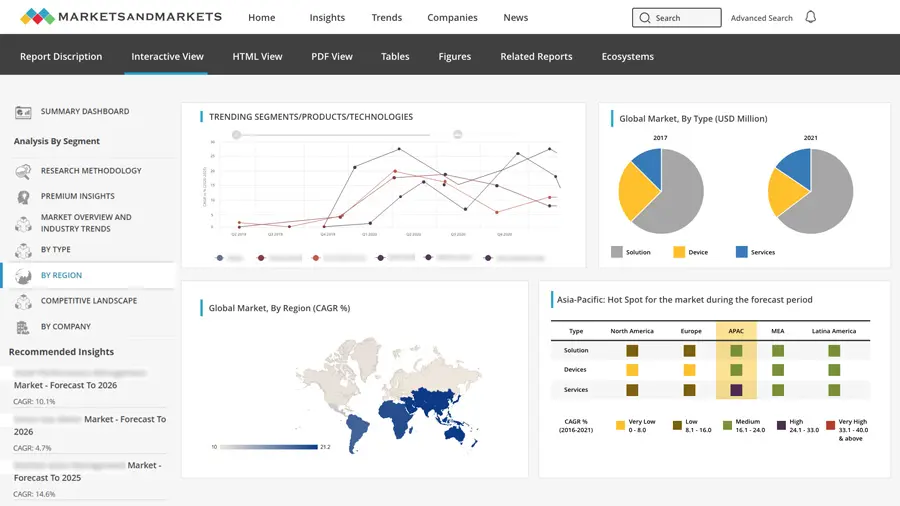

The report covers the Indian bus industry market and is broadly segmented by Fuel type (Diesel, CNG/LPG, and others). The market is further segmented by number of axles (single axle, Multi axle), number of seats, luxury and non-luxury segment, and geography (Asia-Pacific, Europe, North America & ROW) focusing on key countries in each region.

This report classifies and defines the Indian bus market. It also brings qualitative insights and an extensive review of the market drivers, restraints, opportunities, challenges, and key issues in the Indian bus industry.

Table of Contents

1 Introduction

1.1 Key Take Aways

1.2 Report Description

1.3 Glance At Markets Covered

1.4 Stake Holders

1.5 Research Methodology

2 Executive Summary

3 Premium Insights

4 Market Overview

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Burning Issues

4.4 Winning Imperative

4.5 Porter’s Five Force Analysis

4.5.1 Supplier’s Power

4.5.2 Buyer’s Power

4.5.3 Threat Of New Entrant

4.5.4 Threat Of Substitution

4.5.5 Degree Of Competition

4.6 Value Chain Analysis

4.7 Market Share Analysis

5 Technological Overview

5.1 Introduction

6 Indian Bus Industry Market, By Geography

6.1 Asia-Pacific

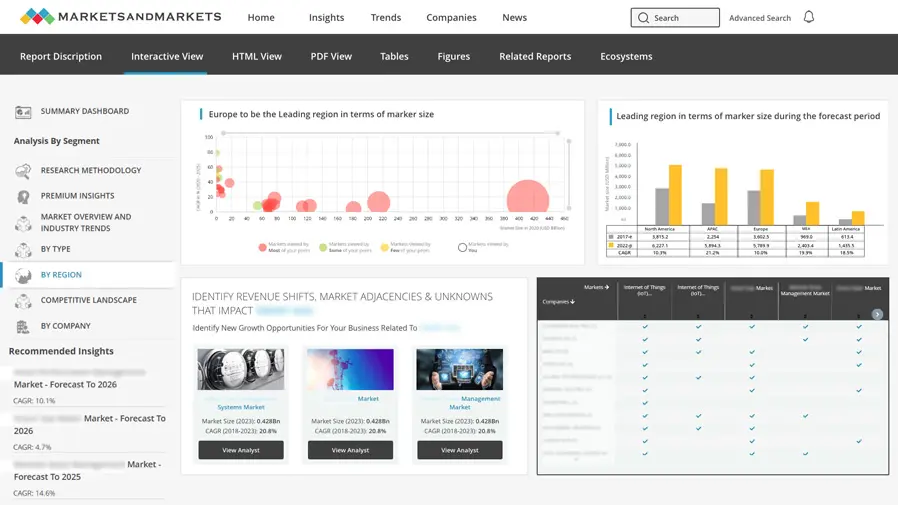

6.2 Europe

6.3 North America

6.4 Row

7 Indian Bus Industry Market, By Fuel Type

7.1 Diesel

7.2 Cng/Lpg

8 Indian Bus Industry Market, By Number Of Axles

8.1 Single Axle

8.2 Multiaxle

9 Indian Bus Industry Market, By Seating Capacity

10 Indian Bus Industry Market, By Segment

10.1 Luxury

10.2 Non Luxury

11 Competitive Landscape

11.1 Introduction

11.2 Market Players

11.3 Expansions

11.4 New Product Launch/Development

11.5 Agreements, Collaborations, Joint Ventures & Partnerships

11.6 Mergers & Acquisitions

11.7 Supply Contracts & Others

12 Company Profiles

Growth opportunities and latent adjacency in Indian Bus Industry Market