Motorcycle ADAS Market by ADAS (ABS, ACC & others), Power Range (<300cc, 300-600cc, 600-1000cc & 1000cc>), Engine Configuration (Single & Multi-cylinder Engine), Component (RADAR, Sensors & Camera), Propulsion Type & Region -Global Forecast to 2025

Over the past few decades, there has been upsurge in road accidents. Rider error is majorly responsible for the accidents. However, there has been increase in initiatives taken by governments and motorcycle manufacturers to reduce road fatality. Driver errors can be minimized by providing driving assistance. Hence, in some countries government has already mandated integration of ADAS functions in motorcycles. Sensor technology is likely to play a crucial role in automated driving, which can efficiently scan the surrounding environment better than human senses, have a better distant vision ahead, detect small obstacles, and manage traffic better. Increasing use of motorcycle ADAS and continuous government initiative is anticipated to improve road safety.

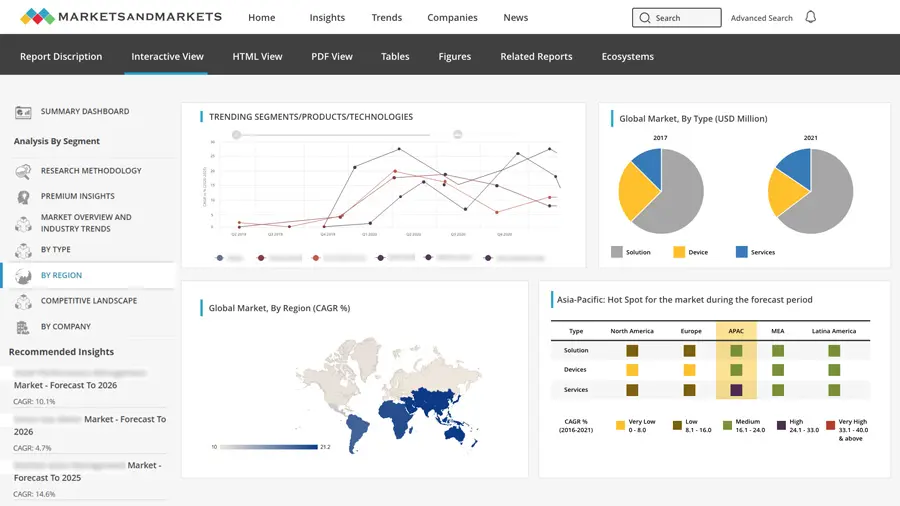

The report highlights the global motorcycle ADAS market, in terms of volume and value. The market volume is expressed in terms of thousand units, whereas the value of the market is expressed in terms of USD million from 2017–2025.

The report features major players in the production of ADAS systems for motorcycles and provides insights about their business strategies. The report also lists the number of ADAS systems being used and the roadmap of their growth in the next five years. It also features drivers, restraints, opportunities, and challenges of the global Motorcycle ADAS market.

Future of Motorcycle ADAS

The integration of ADAS features in a motorcycle has been resulted in improvement of road safety for riders. Moreover, increasing government mandates pertaining to road safety shall propel motorcycle ADAS market. The demand for comfort features in motorcycle is also, which will further boost motorcycle ADAS market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency and Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

1.8 Assumptions

2 Research Methodology

2.1 Secondary Data

2.1.1 Key Secondary Sources

2.1.2 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Sampling Techniques & Data Collection Methods

2.2.2 Primary Participants

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand Side Analysis

2.3.3 Supply Side Analysis

2.4 Market Size Estimation

2.5 Data Triagulation

2.6 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.2 Restraints

5.3.3 Opportunities

5.3.4 Challenges

7 Motorcycle ADAS Market, By ADAS System Type

7.1 Introduction

7.2 Antilock Braking System (ABS)

7.3 Adaptive Cruise Control (ACC)

7.4 Traction Control System (TCS)

7.5 Traffic Sign Assist

7.6 Intelligent Headlight Assist

7.8 Motorcycle Stability Control (MSC)

7.9 Side View Assist

7.10 Forward Collision Warning

7.11 Blind Spot Detection

7.12 Emergency Brake Assist (EBA)

7.13 Tire Pressure Monitoring System (TPMS)

8 Motorcycle ADAS Market, By Power Range

8.1 Introduction

8.2 < 300 Cc

8.3 300-600 Cc

8.4 600-1000 Cc

8.5 1000 Cc >

8 Motorcycle ADAS Market, By Engine Configuration

8.1 Introduction

8.2 Single Cylinder Engine

8.3 Multi Cylinder Engine

9 Motorcycle ADAS Market, By Propulsion Type

9.1 Introduction

9.2 Diesel

9.3 Petrol

9.4 Electric

10 Motorcycle ADAS Market, By Component

10.1 Introduction

10.2 Radar

10.3 Wheel Speed Sensor

10.4 Camera

11 Motorcycle ADAS Market, By Region

11.1 Introduction

11.2 Asia-Pacific

11.2.1 China

11.2.2 Japan

11.2.3 India

11.2.4 South Korea

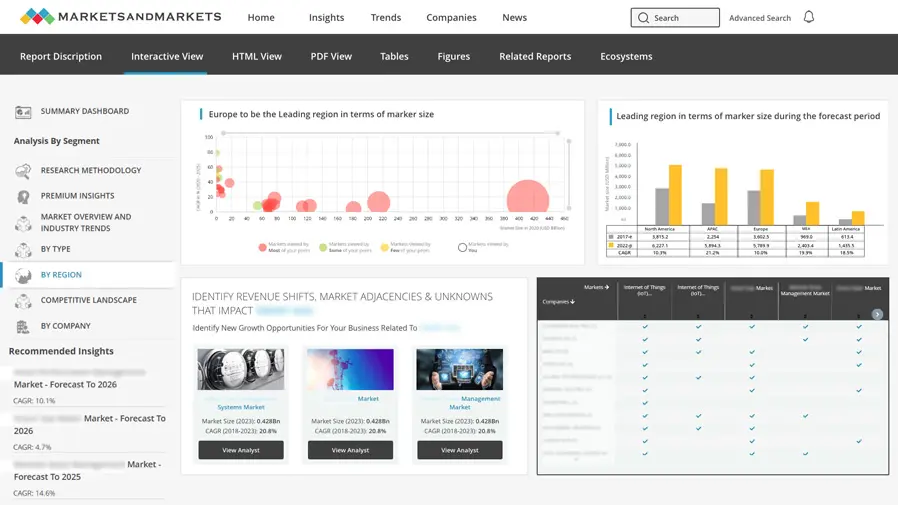

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.3 Spain

11.3.4 Italy

11.4 North America

11.4.1 U.S.

11.4.2 Canada

11.4.3 Mexico

11.5 Rest of the World

11.5.1 Russia

11.5.2 Brazil

14 Competitive Landscape

14.1 Overview

14.2 Competitive Situations and Trends

14.3 Competitive Benchmarking and Landscape

14.3.1 New Product Launches

14.3.2 Expansions

14.3.3 Joint Ventures

14.3.4 Acquisitions

14.3.5 Agreements

14.3.6 Others

15 Company Profiles

15.1 Robert Bosch GmbH

15.2 Continental AG

15.3 BMW Motorrad

15.4 ZF Friedrichshafen

15.5 Garmin Ltd.

15.6 NXP Semicounductors

15.7 Motorcycle Cruise Controls

15.8 Ducati

15.9 Texas Insruments

15.10 Cisco System

16 Appendix

16.1 Discussion Guide

16.2 Introducing RT: Real Time Market Intelligence

16.3 Available Customizations

16.4 Related Reports

16.5 Other Developments

Growth opportunities and latent adjacency in Motorcycle ADAS Market